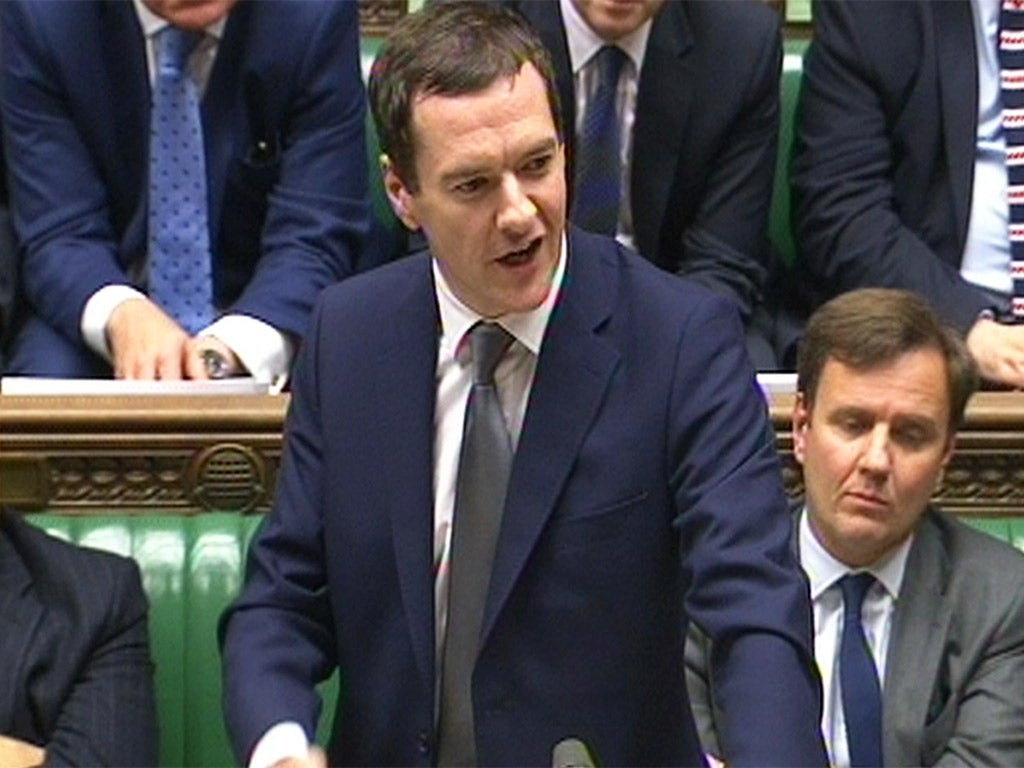

George Osborne is hitting 'hardworking families' with tax credit cuts, says the IFS

The Chancellor's policy is apparently at odds with the goals of other parts of the government

George Osborne has chosen to hit what he would call “hardworking families” by cutting tax credits, the Institute for Fiscal Studies has said.

The respected think-tank said the Chancellor has spared the very poorest in the country from even deeper cuts but that his policy would reduce incentives for people to get a job.

“The Chancellor made quite a big choice in the Budget, he’s decided actually to hit people in work rather harder than people out of work,” director Paul Johnson told BBC Radio 4’s Today programme.

“So he’s actually made the choice, relatively speaking, to protect some of the poorest people on tax credits.

“The cost of that is that he’s hitting rather harder some of those that are in work, thereby reducing work incentives and, of course, hitting what he might call ‘hardworking families’.”

Research conducted by the IFS calculated that only around quarter of money take from families through tax credit cuts would be returned by the new National Living Wage.

The Chancellor has in recent months claimed that the Conservatives are a true "workers party" - claiming that his opponents Labour represent the unemployed.

Tax credits are payments made by the Government to people on lower incomes, most of whom are in work, however.

The claim that the Chancellor’s policy is undermining work incentives is apparently at odds with the Government’s wider stated approach to the issue.

The Department for Work and Pensions, under the leadership of Iain Duncan Smith, has tried to promote work incentives with its new Universal Credit benefits system.

That scheme is supposed to reduce the rate at which benefits are withdrawn from people with they get a job, in order to make it financially beneficial for them to get a job.

The Chancellor has however shown little zeal for this agenda in the past, having previously cut the new programme’s “work allowance” component before it had even come into effect.

George Osborne said earlier this month that people on low incomes would suffer if their tax credit cuts did not go ahead.

“Working people of this country want economic security, the worst possible thing you can do for those families is bust the public finances, have some welfare system this country can’t afford,” the told BBC Radio 4’s Today programme.

“That includes a tax credit bill that’s gone up from the £1bn when it was introduced to the £30bn today.”

David Cameron has also ruled out a U-turn on the policy.

Public opposition to the policy appears to be hardening, with a ComRes poll for the Independent On Sunday suggesting that 43 per cent disagree that the cuts are needed – compared to 34 per cent who do.

Mr Cameron effectively ruled out cutting the benefit before the election, telling a voters’ question time event that he “rejected” proposals to cut tax credits and did not want to do so.

The cuts are part of £12bn welfare cuts that the Conservatives say they will make to hit their deficit targets.

A study by the Resolution Foundation think-tank found that 200,000 children would slide into poverty immediately after the tax credit cuts go ahead.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks