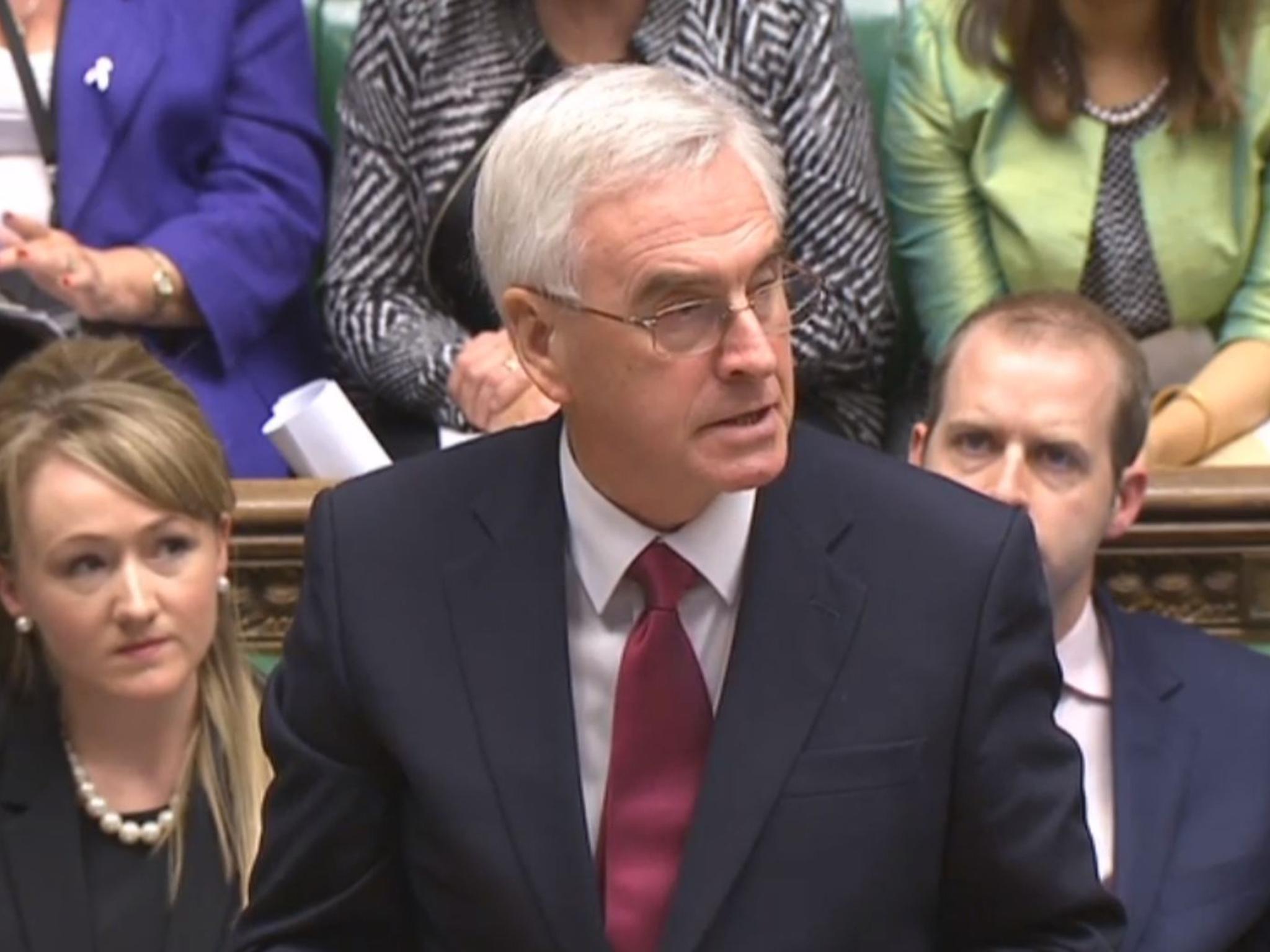

Labour will not raise taxes, says Shadow Chancellor John McDonnell

The Opposition would 'use our resources more effectively', rather than hike taxes, Mr McDonnell says - as he backs the 'triple lock' for pensioners

Labour has insisted it would not raise people's taxes, as it sought to squash Conservative claims it is a big-spending party.

Shadow Chancellor John McDonnell said Labour, if elected, would “use our resources more effectively” to tackle growing social problems – only increasing spending on investment.

Instead, Labour has provoked some criticism by supporting the Government’s effective tax cut for higher-earners, by raising the threshold for people paying the 40p rate.

Today, Mr McDonnell also committed his party to keeping the ‘triple lock’ - which says pensions must rise every year by 2.5 per cent, or in line with earnings or inflation, whichever is higher.

That commitment comes despite Chancellor Philip Hammond hinting the Conservatives could drop the policy after 2020, because it is simply too expensive.

During an interview with the BBC, Mr McDonnell found himself in the unusual position of being accused of being “not radical enough” and having “critics on the Left”.

Insisting Labour would not increase the overall tax burden, Mr McDonnell said he would only increase investment spending – to the international average for high-income economies of three per cent a year.

He said: “We’d make sure that, instead of giving tax giveaways to the wealthy and corporations - and ignoring the issue of tax avoidance and tax evasion - we’d make sure we had a fair taxation system.

“And, in that way, we’re not talking about increasing taxes or anything like that. What we are saying is that we use our resources more effectively. We will want to abide by the principles that you spend what you earn.

“They have given tax giveways on capital gains tax, on corporation tax, on inheritance tax to the wealthy in our community and also to corporations.”

On backing a higher 40p tax rate threshold, Mr McDonnell said: “There are large numbers of people earning above £43,000 who are in jobs like train drivers, like senior teachers and others, who have been hit and do need protecting.

“Our policy is 50p on £150,000, reverting to the original tax system we had some years ago.”

And, asked if Mr Hammond should drop the triple lock, Mr McDonnell said: “No, I would be very disappointed if he did.

“If we can grow the economy, and we have a fair taxation system, we can afford it.”

The Shadow Chancellor also warned that the government’s failure to set out its Brexit strategy was the cause of much of the economic gloom.

“People need to know where is the government going and how is it going to get there,” he said.

“At least then you stabilise things and people will be able to settle down into serious negotiations and we will get the best deal. Until the government gets to that position, we are going to have these uncertainties and this speculation.”

Britain was “unprepared and ill-equipped for Brexit” because of the Conservative Government's decision to ban the Civil Service from drawing up plans for a possible Leave vote.

And the investment boost by Mr Hammond - around ten per cent, according to one independent analysis - was “too little, too late”, after six years of austerity cuts.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks