How tax revelations turned a leadership bid into survival talks for Rishi Sunak

As the chancellor faces a series of revelations, crisis meetings turn from how to rethink his leadership bid to how he can stay in his current role

In January, as the Partygate scandal raged, members of Rishi Sunak’s core team were working out over dinner which jobs they would take when the chancellor became prime minister. There were jokes about changing the interior design of the larger flat at No 11, currently the prime minister’s residence, on WhatsApp.

The copy for the website for his leadership campaign, based on the format of the No 11 newsletter, was ready to go.

When The Independent revealed that Boris Johnson had called his Partygate comeback campaign Operation Save Big Dog, one of the core messaged a friend with a screenshot saying “He’s finished”.

So confident were the chancellor’s team that the Twitter handle for the “Ready for Rishi” campaign was already prepared, along with a wider communications campaign informed by data harvested from the same newsletter, in a neat dashboard built by Mr Sunak’s tech-savvy team.

He and his close circle held informal meetings with MPs and senior figures in the Tory party in order to gauge his chances of winning a leadership contest, and to measure the fallout from senior civil servant Sue Gray’s investigation and that of the police, it was claimed. The ground was laid.

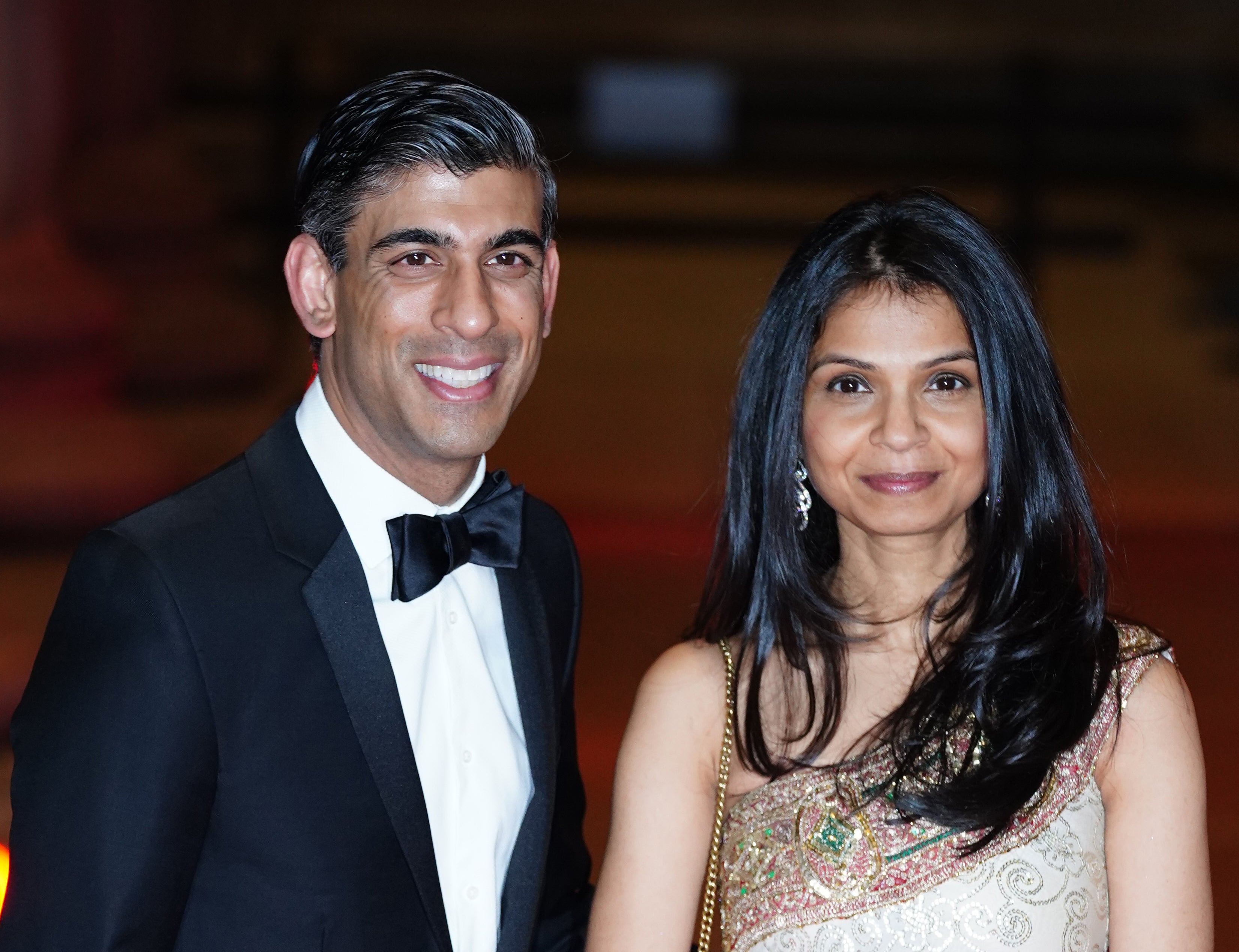

Revelations about his wife’s financial affairs, first reported by this publication, appear to have changed the chancellor’s plans, at least for now.

Crisis meetings throughout the past week have turned from how to rethink a leadership bid to how he can survive in his current role. Relations with his neighbour Mr Johnson’s team have turned from challenging to outright sour.

“Did you know anything about this?” one No 11 staffer messaged a No 10 equivalent. The recipient had not known about it, but paranoia in both camps continues to build.

A spokesperson said there had been no leaks from No 10. The prime minister said that he had not known about Ms Murty’s tax affairs.

Mr Sunak’s stock had arguably already dropped in the aftermath of the mini-Budget last month. His spring statement was met with a cold response on the back benches. The “jam tomorrow” – a penny off income tax ahead of the next election – failed to recognise that “there isn’t going to be enough bread for everyone” today, one cabinet minister told The Independent.

Several Tory MPs are also concerned that the chancellor’s measures fall short for those in greatest need. Economic analysis from left and right has shown a grim outlook for the poorest ahead of the local elections. Indeed, “No one needs to look at a chart from a think tank to know that people are struggling and the government isn’t doing enough,” said one MP.

Into this atmosphere of disquiet about the cost of living came fresh problems. After an extensive investigation by The Independent it was revealed that Akshata Murty, Mr Sunak’s wife, was using non-dom tax status. It had – entirely legally – saved her millions on her foreign earnings.

It put the couple in a politically awkward spot at a time when UK households, many of whom cannot afford to put their heating on, are facing a near 10 per cent, 1.25 percentage point, increase in their tax bill.

It also caused disquiet among senior Treasury officials whose work involves trying to make the UK appealing to foreign-born entrepreneurs. One said that, in their view, there was “good reason to share this information more widely to leaders of relevant policy teams”.

A senior G7 diplomat, who is not British and who has worked with Mr Sunak on efforts to improve corporate tax transparency, said they would have preferred to know more about the potential conflicts at play.

Shortly before the mini-Budget, Mr Sunak had suggested to a contact from his former life in finance that if he couldn’t make it to the top job soon, he might return to the industry before the next election. He also mentioned that he was in desperate need of a proper holiday, having cut short and cancelled recent trips to the US.

It is not the only signal that the chancellor might feel torn between the worlds of politics and finance. It was reported that he and his wife had held on to US green cards, which are supposed to be awarded on the basis of an intention to make the US your permanent home, while he was chancellor. This adds to the picture of a politician who would prefer not to have to choose between a life of public service and a highly successful career in money-making.

His wife’s U-turn on paying tax on her foreign income in the UK, after the chancellor had previously suggested this was incompatible with her Indian citizenship, is also a hedged bet. She will no longer use the option on her tax return, but she has determined that she will keep her non-dom status.

Open questions remain about beneficial inheritance-tax arrangements and overseas tax-haven trusts. Allegations and evidence suggesting the chancellor is named as a beneficiary of some of these trusts were not met with an outright denial.

Being rich is no bar to a successful political career – either in the UK or on the wider international circuit – and Mr Sunak’s stock might recover, but right now it’s looking like a tough margin trade. MPs on his own side may need to see Mr Sunak double down on his commitments in the UK if they are ever going to be Ready for Rishi as leader.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks