Trump’s tariffs are set to cost the average household an extra $1,300 this year, study finds

The sweeping levies amount to the largest tax increase since 1993, the study found

President Donald Trump has long insisted that Americans don’t shoulder the burden of his tariffs. However, new research indicates that his sweeping levies are set to raise household costs this year — representing the largest tax increase in a generation.

The average American household will pay an extra $1,300 in 2026 due to Trump’s tariffs, up from $1,000 in 2025, according to a study this month from the Tax Foundation, a non-partisan think tank in Washington, D.C.

The president launched his unprecedented tariff regime last April, imposing so-called reciprocal levies on dozens of countries — including key trading partners like China and the European Union — alongside a universal 10 percent rate on all imports. Since then, the administration has repeatedly delayed, canceled and reinstated these measures, while threatening more, creating ongoing uncertainty.

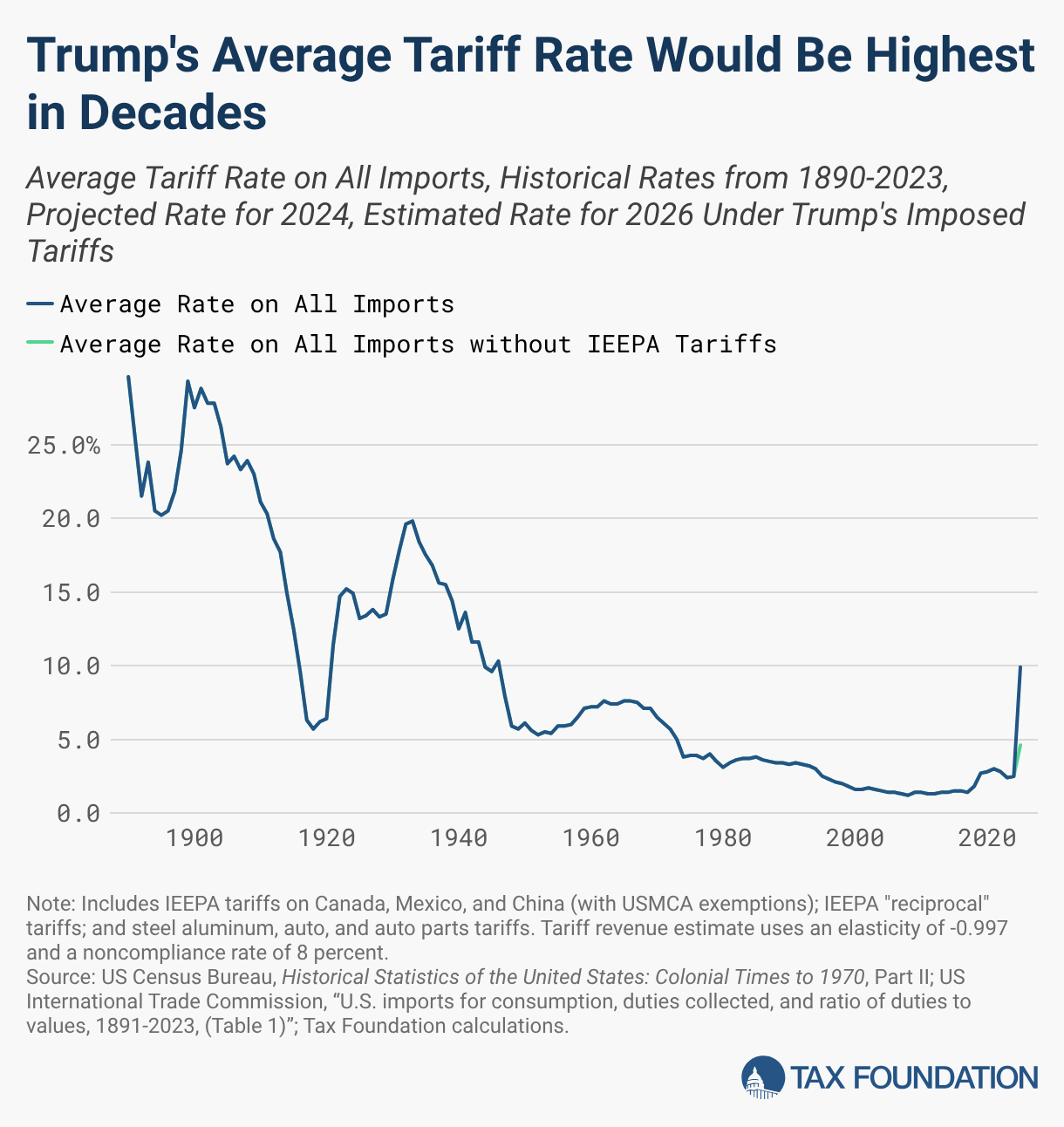

The Tax Foundation calculated that the average effective tariff rate on all U.S. imports is now 9.9 percent, making it the highest average rate since 1946.

“The Trump tariffs are the largest US tax increase as a percent of GDP (0.54 percent for 2026) since 1993,” the study added.

The levies raised $132 billion in tax revenue last year and are projected to generate about $2 trillion over the next decade when foreign retaliation is not accounted for. With negative effects priced in, the estimated revenue falls to $1.6 trillion.

Meanwhile, the president’s tariffs are projected to reduce GDP by 0.5 percent. They also risk undermining the economic gains from Trump’s tax cuts in his “Big, Beautiful Bill” without generating enough revenue to offset their cost.

“Historical evidence and recent studies show that tariffs are taxes that raise prices and reduce available quantities of goods and services for U.S. businesses and consumers, resulting in lower income, reduced employment, and lower economic output,” the study concluded.

The White House, though, quickly dismissed the findings from the study.

“The average American tariff has increased nearly sevenfold in the past year, while inflation cooled, real wages increased, and economic growth accelerated – the exact opposite of what the ‘experts’ said would happen,” Trump spokesperson Kush Desai told The Independent. “More pointless studies are not going to change the fact that President Trump was right and the Panican experts were wrong.”

But nearly all Democratic lawmakers, plus some Republicans, have expressed opposition to the sweeping tariffs unilaterally imposed by Trump.

“American families will soon pay higher prices for avocados and appliances, diesel fuel and dog toys, car parts and Christmas lights, tomatoes and tequila, beer and gas,” Sen. Chris Coons, a Delaware Democrat, said in a recent statement addressing the tariffs. “It’s the largest tax increase on working Americans in a long time, and it will cost them thousands of dollars every year. President Trump is making America expensive again.”

The public appears to agree with this sentiment, according to recent polls. A February survey from the Pew Research Center found that 60 percent of Americans disapprove of the president’s increased tariffs, while 37 percent said they approve.

The latest study from the Tax Foundation comes at a critical juncture for the administration’s trade policy. The U.S. Supreme Court is set to rule on whether the president holds the authority to unilaterally impose tariffs, but it is unclear when its decision will be handed down.

Trump has warned that, should the high court rule against him, the nation will be “SCREWED!”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks