US rate rise: Historic and hazardous step may herald new era for world economy

First US rate rise for 10 years brought an end to an unprecedented era of monetary easing

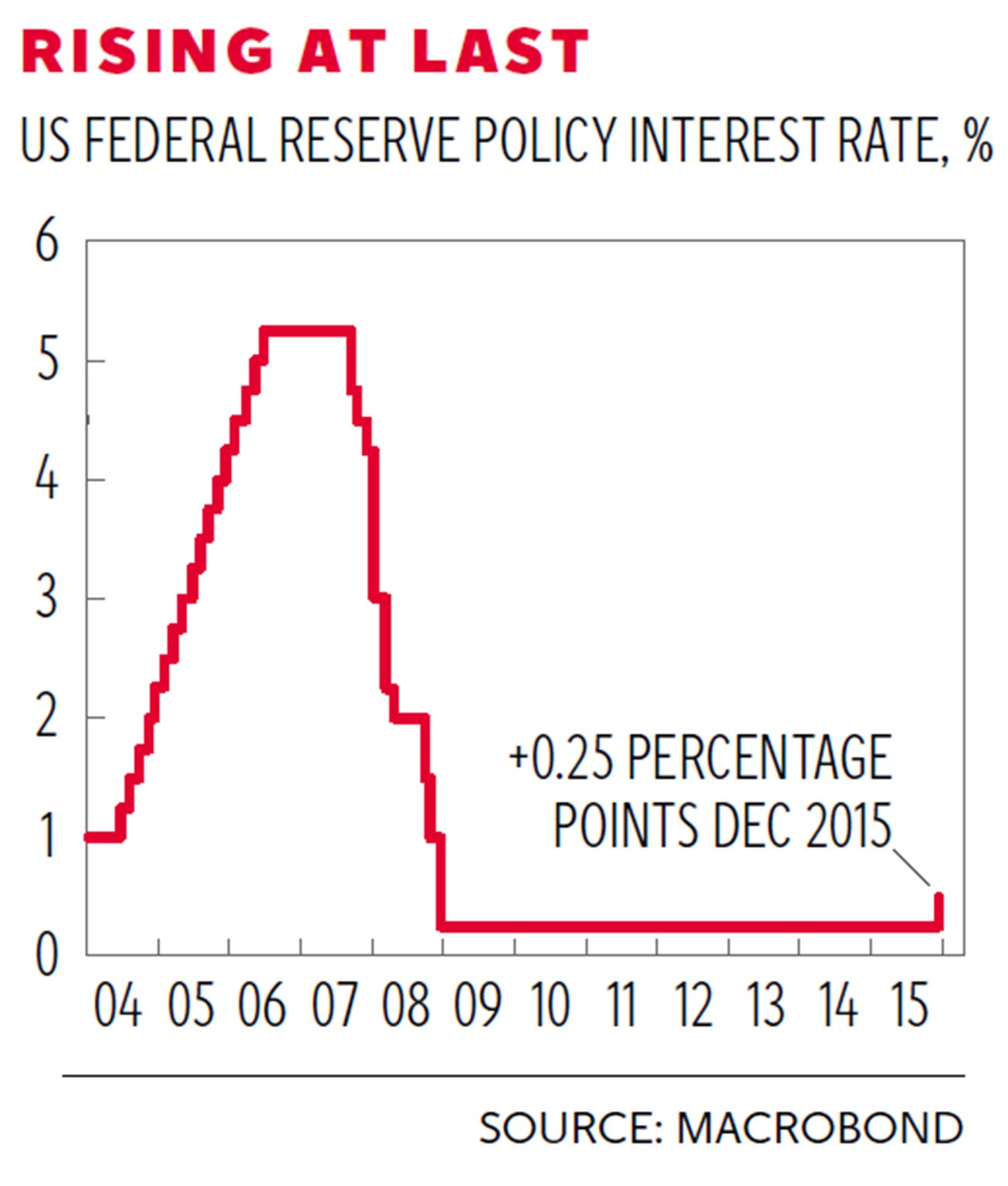

America’s central bank took a historic and potentially hazardous step on Wednesday night when it raised interest rates for the first time in almost a decade, in a move that reflects a conviction among the country’s most senior monetary officials that the US economy is finally healthy enough to cope with a higher cost of borrowing.

The Federal Reserve, chaired by Janet Yellen, lifted rates from their historic low of 0.25 per cent to 0.5 per cent, bringing an end to an unprecedented era of monetary easing, which had been put in place to prevent America sinking into another 1930s style Great Depression.

Some economists believe the Fed’s rate hike could also signal a major turn in the global interest rate cycle, meaning the cost of borrowing could start to rise relatively soon for the UK too, pushing up mortgage repayments for millions of British families.

UK rates have been nailed to a historic floor of 0.5 per cent by the Bank of England since 2009. Despite the Fed’s move yesterday the Bank of England’s governor, Mark Carney, has recently tried to play down the idea the UK could follow in quick succession. Official statistics released yesterday showed a slowdown in average UK wage growth in the three months to October, one of the key indicators of inflationary pressure analysed by the Bank’s Monetary Policy Committee.

Financial markets are presently pricing in the first UK rate rise for December 2016, although City of London analysts expect it to arrive in the second quarter of next year. In the most recent meeting of the nine person MPC there was an eight to one vote in favour of keeping rates on hold.

Attention now turns to the question of how rapidly the Fed will continue raising interest rates and to what level. In previous cycles the Fed has raised rates rapidly, but in a press conference last night the Fed Chair Janet Yellen said the process this time “is likely to proceed gradually”.

Some prominent and respected economists cautioned against a rate rise, warning that the central bank could be on the verge of a serious policy error by tightening monetary policy too early. The Harvard economics professor Larry Summers, who was narrowly beaten to the Fed chair in 2014 by Ms Yellen, said higher borrowing costs could hold back the US economy unnecessarily and also exacerbate global financial instability. “I look at today’s American economy and I say this is not a moment to be hitting the brakes even gently” he argued. The Nobel economics laureate Paul Krugman also warned against increasing the cost of borrowing while the US economy is still underperforming by historic standards. The US democratic presidential candidate Bernie Sanders said last night the rates decision was “bad news for working families”.

The last time the Fed put up its main policy rate was June 2006, when policymakers were concerned about the inflationary impact of spiking global oil prices. In that month the former Fed chair, Ben Bernanke, raised rates to 5.25 per cent. The Fed reversed itself and began to cut rates rapidly in September 2007 when the credit crunch began to bite. Rates hit an all-time low of 0.25 per cent in December 2008, as banks around the world collapsed. Rates remained there until yesterday. The Federal Reserve also felt it necessary to inject a further $4.5 trillion of money into the American financial system by buying US government debt and other securities in order to boost economic activity.

The American economy has been growing steadily since 2009 and the unemployment rate has halved from 10 per cent to 5 per cent in the most recent figures. But GDP growth has been weak in comparison with previous American recovery cycles, with the US recovery still not back to where its pre-2008 trend would have taken it. And the US employment activity rate has fallen from 66 per cent to 62 per cent in the past six years, which some economists argue signals that there remains a considerable amount of slack in the economy.

The Fed put up rates in order to head off the risk of excessive domestic consumer price inflation. The most recent core inflation reading, which excludes volatile energy and food prices, earlier this week from the US Labor Department showed a 2 per cent annual increase in November, right on the Fed’s target. However, overall inflation was just 0.5 per cent, reflecting the collapse in the global oil price.

A UK rate rise would hold be likely to hold back household expenditure. An annual survey of UK household finances by the Bank of England this week found that almost a third of households would need to reduce their spending, work more or rearrange their mortgage payments if UK rates rose by 2 percentage points without any increase in wages.

The European Central Bank and the Bank of Japan are showing no signs of following the Fed and raising their own interest rates. Earlier this month Mario Draghi, the ECB president, announced another cut in the eurozone’s interest rate and a six month extension of its asset purchase programme. Japan is still trying to escape the damaging clutches of two decades of deflation or ultra-low inflation.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks