Greece is open for business again - but critics suggest visit of German Chancellor Angela Merkel is behind bonds sale that will cost more in borrowing

The Athens government’s attempt to raise billions of euros on the bond markets is being taken as a sign that the worst of the crisis may be over. But the mood on the streets tells a different story

Support truly

independent journalism

Our mission is to deliver unbiased, fact-based reporting that holds power to account and exposes the truth.

Whether $5 or $50, every contribution counts.

Support us to deliver journalism without an agenda.

Louise Thomas

Editor

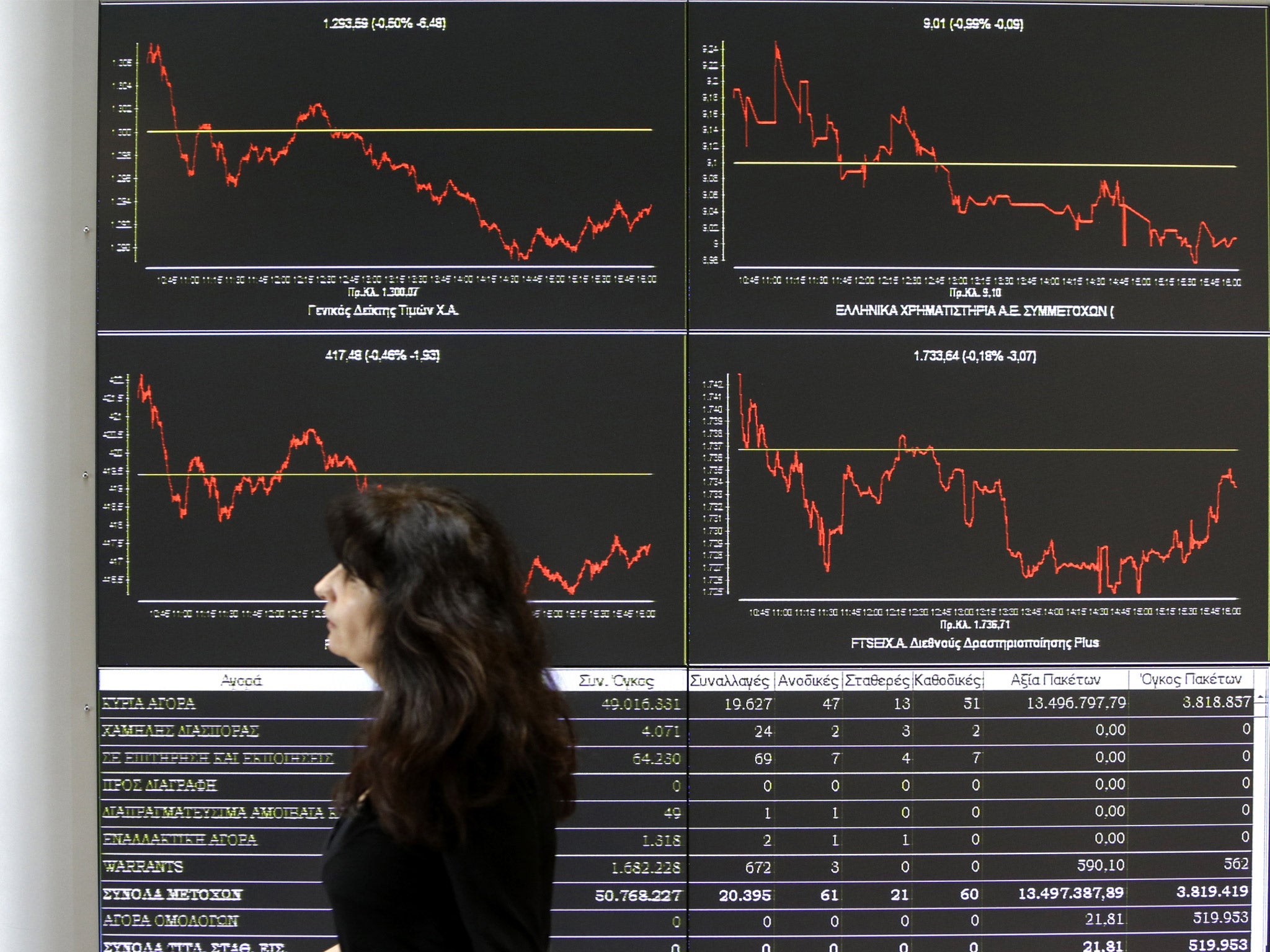

After almost six years of economic turbulence and misery for many millions of people, the Greek government has signalled that perhaps the worst was over as it announced that it would return to international credit markets.

The announcement came amid a peaceful nationwide demonstration organised by trade unions to protest against the still harsh austerity measures that have wiped away a quarter of the country’s economy.

The finance ministry declined to give further details on the timing and size of the bond offering but sources said the debt would be issued by the end of today with the executive in Athens hoping to raise at least €2bn (£1.6bn).

Initial reports indicated that investors have already placed orders for €11bn worth of bonds, well above expected, suggesting that not only will the Greek government be able to trim the interest it pays, but more significantly, that the international financial markets are once again available to the battered Greek economy. It is believed that the interest rate payable on the bonds will be close to five per cent.

“This is of monumental significance,” said Jason Manolopoulos, managing partner of Dromeus Capital, a hedge fund, and author of Greece’s Odious Debt. “This marks the end of the sovereign debt crisis for Greece after four years of no access to the debt markets.”

Greece has suffered more than most since the onset of the international financial crisis in 2008 and 2009. Huge cuts to public expenditure, made necessary as a condition of bailouts worth more than €200bn (£160bn) from the European Union and International Monetary Fund, have left Greece with unemployment at 28 per cent and anti-government sentiment at an all-time high.

Data suggests the overwhelming majority of those without jobs have been unemployed for over a year leaving them without access to state benefits and heavily reliant on strong family ties.

Children are also severely affected by economic woes, with Unicef recently announcing that a third of minors are threatened with poverty.

Despite the gloom, the conservative New Democracy-led coalition government has sounded increasingly confident in recent months and the economy is expected to return to growth later this year, albeit at anaemic levels. “It is an important step for Greece on its efforts to get out of the crisis and regain confidence in its economy,” Simos Kedikoglou, the government spokesman told The Independent.

Despite the upbeat reception from the markets, Greece’s national debt still stands at a colossal 175 per cent of national output.

Dimitri Mardas, a professor of economics at Thessaloniki University, argued that the bond would be too pricey for a country with a tiny growth forecast this year and high pre-existing debt

“Can the Greek economy, with its limited dynamic, take borrowing costs of five to six per cent, even though these are the lowest in the past four years?” he said. “Probably not, so the vicious circle of over-indebtedness will continue.”

Professor Mardas said the bond issue would likely attract investor interest due to the high returns likely to be offered. “Whoever is fast enough will take advantage of that,” he said. “But Greece will be burdened with new onerous interest rates.”

The left-wing opposition found little in the announcement to celebrate and branded the government’s return to the markets as little more than a PR stunt.

“They’re borrowing at 5 per cent instead of the current 1.5 per cent, [and] increasing public debt. [The coalition government] is doing the most expensive electoral campaign, out of state funds,” Syriza MP Dimitrios Papadimoulis said in a tweet.

Others also voiced their criticism, saying the move benefited the government ahead of crucial European and municipal elections next month, which will prove a litmus test for the coalition government. Sofia Voultepsi, the parliamentary spokesperson of the New Democracy party – a coalition member – snapped back at the opposition, saying as the country’s economic fortunes improve, Syriza – The Coalition of the Radical Left – loses its raison d’être.

Analysts point out that Greece has no immediate financing needs and by issuing bonds it could end up paying more than eight times the interest rate it currently pays on loans granted by the EU and IMF.

Independent economist Vagelis Agapitos agreed that the move was politically motivated, coming ahead of German Chancellor Angela Merkel’s visit to Athens on Friday.

“The success of the issue ahead of Merkel’s visit demonstrates to German voters the Greek bailout is working, and to Greek voters that Greece is turning the page, however these political benefits have a much higher economic cost given the alternative of borrowing from the IMF and EU at a much lower rate.”

The government is also embroiled in a domestic scandal after an aide of the prime minister was caught on video admitting pressuring the judiciary to act against MPs from the far-right Golden Dawn party, some of whom now face serious criminal charges. The aide has since resigned.

Despite the administration’s attempts to capitalise on increasing financial optimism, the mood among Greeks in the demonstration was markedly different. Spiros Stromboulis, a naval architect, was one of thousands that marched in front of Athens’s parliament today. He said that he led a comfortable life before the crisis, but that a slew of tax increases and cuts to public spending had led to a steady decline in his standard of living. “Are we supposed to be celebrating because Greece will borrow more money? Debt is what triggered our crisis to begin with.”

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments