Bitcoin price: No-deal Brexit 'will see cryptocurrency value hit record high'

A no-deal Brexit could see 'a massive and unprecedented breakout' in 2019, one analyst predicts

The surging price of bitcoin could reach record highs in the coming months if the UK leaves the European Union without a deal, according to some cryptocurrency analysts.

The looming prospect of a no-deal Brexit has already caused the pound to slump against other major currencies, including the euro and US dollar.

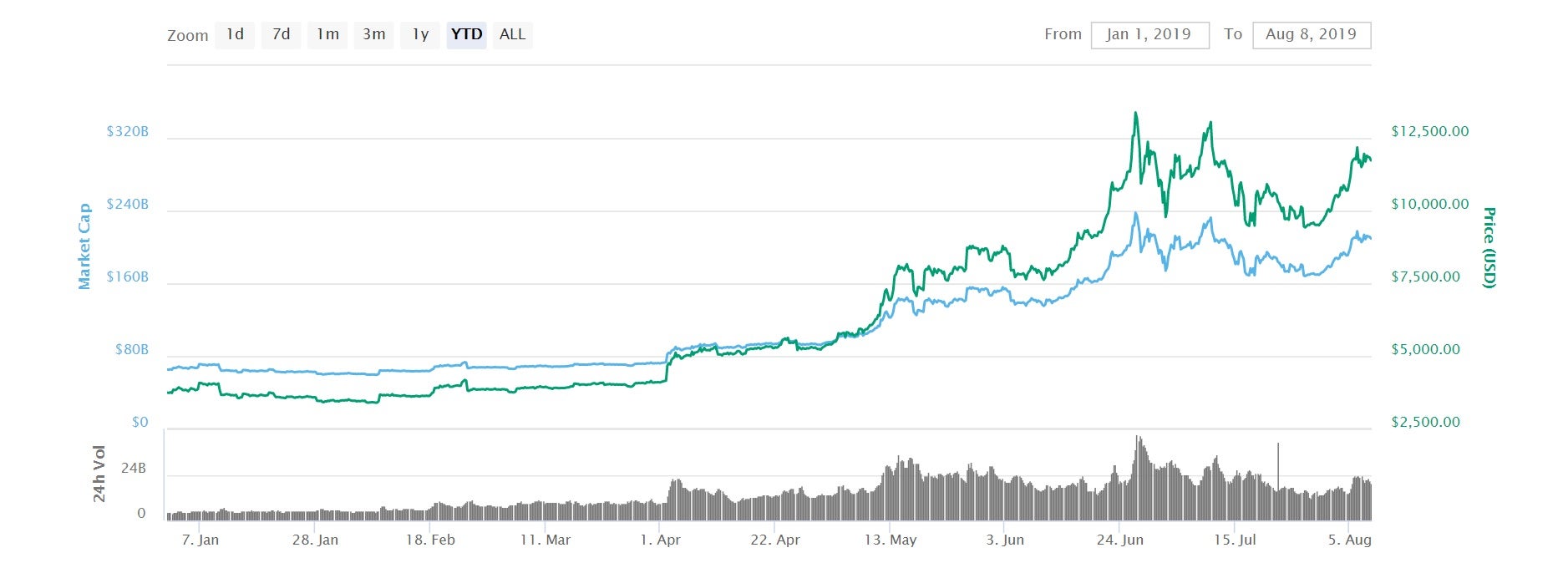

Meanwhile bitcoin has experienced a resurgence in recent months, with ts value rising by around $4,000 since late June to its current price of $12,000.

It still remains a long way off its record high of $20,000, which it hit in late 2017, but experts believe geopolitical uncertainty could push it beyond that point before 2020.

“Bitcoin has rediscovered its mojo this year with multiple mini surges but a no-deal Brexit could see a massive and unprecedented breakout,” Nicholas Gregory, CEO of blockchain firm CommerceBlock, told The Independent.

“Not only will a no-deal departure from the EU create turmoil and volatility across two major fiat currencies, it will also trigger an identity crisis for the global system as the contingency and vulnerability of major global fiat currencies is laid bare.”

The price of bitcoin is notoriously volatile, however some investors are beginning to see it as a safe-haven asset due to its finite supply.

Its borderless and decentralised infrastructure also means it is less prone to the effects of a single country or market.

Nigel Green, the chief executive of financial consultancy firm deVere Group, recently called bitcoin a “flight-to-safety asset during times of market uncertainty”, claiming it is gaining a reputation as digital gold.

Data collected by Bloomberg earlier this week appeared to reaffirm this opinion, with bitcoin’s price correlation to gold doubling over the last three months.

This has been aided by other geopolitical uncertainty in the form of rising trade tensions between the US and China.

“Gold, the traditional haven asset, has been a beneficiary of some of this investor uncertainty,” Simon Peters, an analyst at the online trading platform eToro, told The Independent.

“Yet bitcoin also seems to have served a similar purpose. Given that Chinese investors make up a large proportion of crypto investors, there’s a strong possibility some are backing bitcoin’s chances against the yuan.”

The current Brexit deadline for the UK to leave Europe is set for 31 October, 2019, though previous dates have been postponed due to parliament being unable to agree upon the deal negotiated by previous prime minister Theresa May.

Her successor, Boris Johnson, has consistently claimed that Brexit will happen by 31 October, with or without a deal, with some warning this could be a catastrophe for the UK and global markets more broadly.

Carolyn Fairbairn, the director of the Confederation of British Industry (CBI), said in a recent op-ed in the Financial Times that a no-deal Brexit would be a “tripwire into economic chaos”.

Should this prove true, Mr Gregory claims bitcoin’s place within the global economy could fundamentally shift.

“Come 2020, we expect an increasingly populist and politically unstable world to cement the safe haven status of bitcoin and other cryptocurrencies more generally,” he said.

“And if central banks revert to ramping up the money printing all over again, the case for cryptocurrencies like bitcoin whose supply is capped will be further reinforced. Each time a central bank increases the money supply, it’s another nail in the coffin of fiat.”

We’ve teamed up with cryptocurrency trading platform eToro. Click here to get the latest Bitcoin rates and start trading. Cryptocurrencies are a highly volatile unregulated investment product. No EU investor protection. 75% of retail investor accounts lose money when trading CFDs.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks