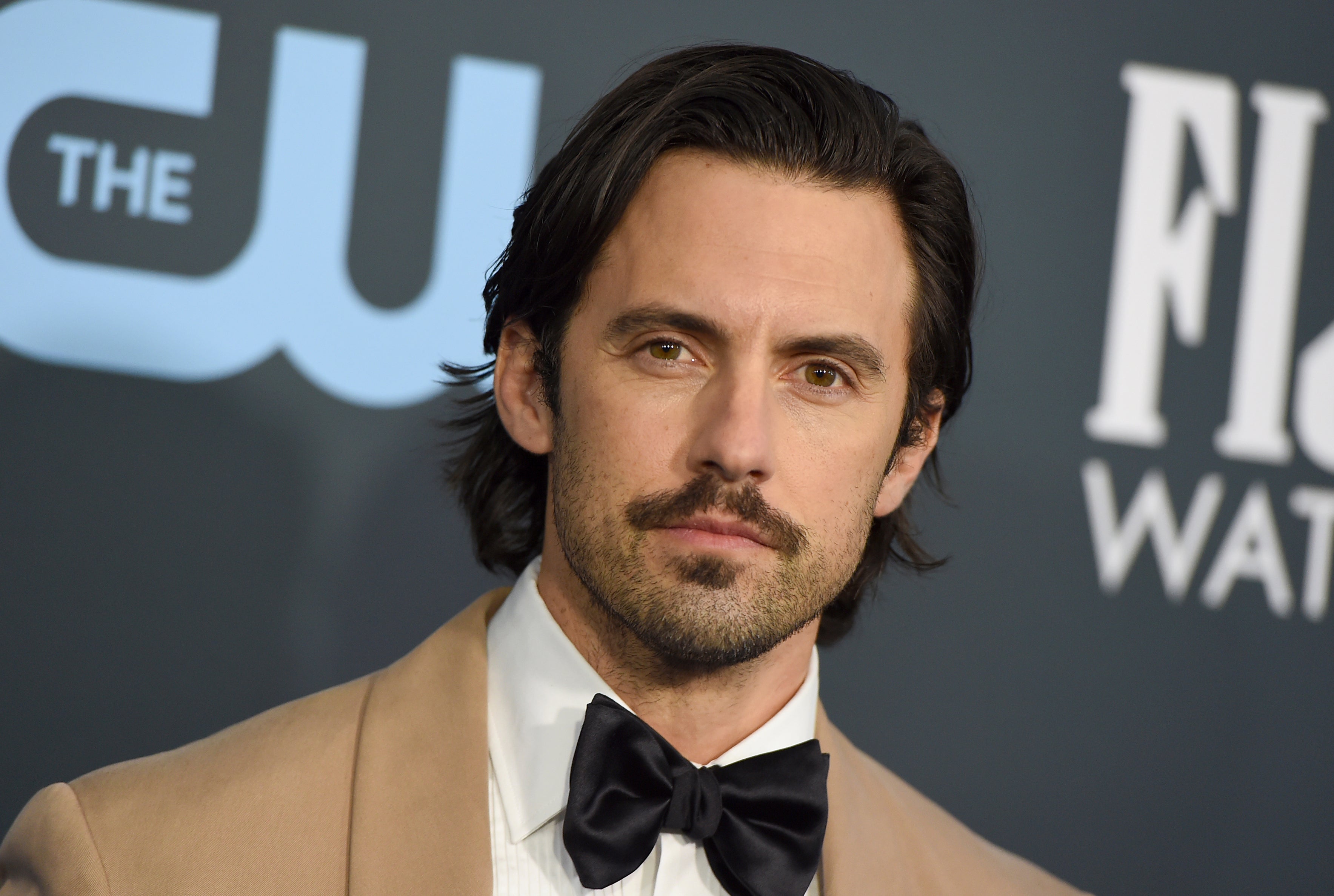

Playing the waiting game: Experts react to ‘This Is Us’ star Milo Ventimiglia’s personal money mantra

‘For any big-ticket want, not a need, we use a simple rule: pause, write it down, and set a future date to revisit it,’ one expert said

You can debate whether Jess was the right guy for Rory Gilmore, but experts agree: Gilmore Girls and This Is Us actor Milo Ventimiglia has got some helpful money advice.

When Us Weekly asked Ventimiglia about the best financial advice he ever received, he said: "Something my mom would say to me, ‘If you really want something, wait until you just can’t stand it any longer.’" His wait-now, buy-later philosophy resonated with Erika Rasure, chief financial wellness advisor at debt consolidation service Beyond Finance.

“I love this advice,” Rasure told The Independent by email. “I often recommend a ‘pause before purchase’ practice, not as a form of deprivation, but as a way to emotionally regulate. When you still want it after the emotional storm passes, that clarity helps reveal whether it’s a meaningful want or simply impulsivity talking.”

Forcing yourself to wait on certain purchases will help you avoid emotional spending and build better money habits over time.

Why waiting benefits your wallet

Time is a great way to help you identify purchases that are purely based on emotions and impulse versus purchases you actually need.

“I think it's great advice because it naturally dampens the impulsivity of your decision-making, which can be a crux for many people,” said Luther Yeates, head of mortgages at UK Expat Mortgage.

Not only does the approach teach you to resist impulses, but it can impact more than just your self-control, Yeates said.

“In the mortgage industry, we're always advising customers to avoid any big purchases (cars, holidays, etc.) in the 3-6 months before getting a mortgage, as banks don't like to see impulsive spending – and there's a reason for that: It's dangerous,” he said in an email to The Independent.

Putting your own spin on Milo’s mantra

While Ventimiglia didn’t say how long you should wait, Jim Wang, founder of personal finance site Wallet Hacks, said one to two days is a good baseline.

“A cooling off period of 24-48 hours on things like that is healthy because you'll often find the desire to purchase it … goes away and you forget about it,” Wang told The Independent via email. “If you still remember, it may be a good signal that you truly want it.”

Dean Lyulkin, CEO at business financing firm Cardiff, said he often teaches his kids a modified version of Ventimiglia’s approach. Instead of waiting as long as you can, he suggests taking a more intentional approach.

“For any big-ticket want, not a need, we use a simple rule: pause, write it down, and set a future date to revisit it, but only after tying the purchase to a goal or objective,” he told The Independent in an email. “That way, if they still want it later, it feels earned, not like giving in to an impulse.”

One drawback of Ventimiglia’s approach is that waiting until you can’t stand waiting any longer is akin to surrendering to an emotion as opposed to waiting a specified period of time, Lyulkin said.

“Over time, this trains your brain to associate spending with intention and progress, not emotional relief,” he said. “It works just as well for adults as it does for teenagers, because the real skill isn’t patience. It’s learning to turn desire into a deliberate, goal-driven decision.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks