Saks may be heading for bankruptcy despite raising billions: report

Saks’ $2.65 billion acquisition of competitor Neiman Marcus put the company in more debt

Saks Global Enterprises may be heading for bankruptcy despite raising billions to turn things around for the luxury retailer, according to a new report.

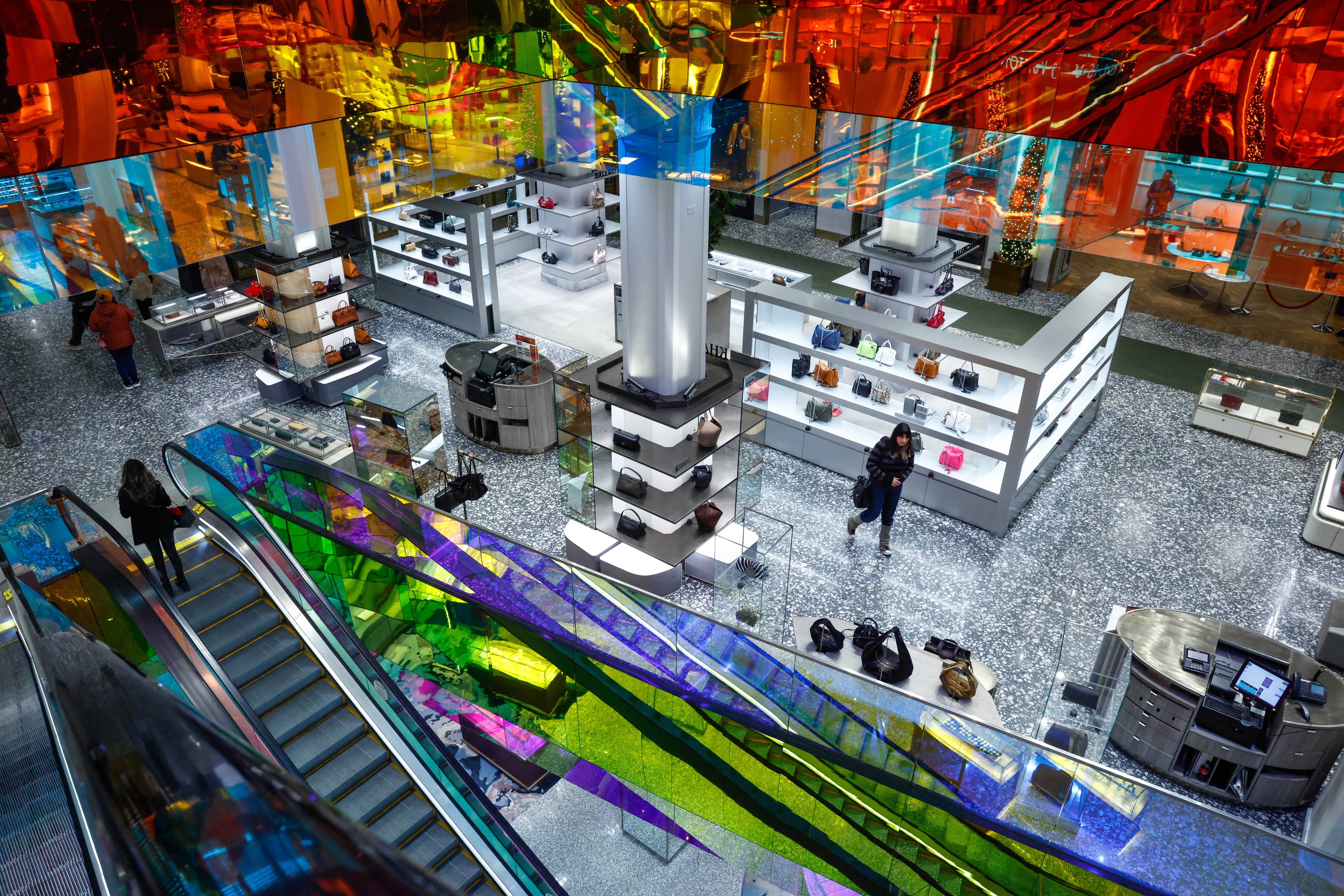

If not for its clothes, you may know Saks Fifth Avenue for its spectacular light show on the facade of its flagship store in Midtown Manhattan during the holiday season or the infamous moment actress Winona Ryder shoplifted from its Beverly Hills store in 2001.

Unnamed sources with knowledge of the matter told Bloomberg Saks was considering filing for Chapter 11 bankruptcy as a last option while a deadline to pay off more than $100 million looms.

Saks raised billions from bond investors last year in hopes that its $2.65 billion acquisition of competitor Neiman Marcus would save the struggling company. The Saks-Neiman Marcus merger combined Saks Fifth Avenue, Saks Off 5th, Neiman Marcus and Bergdorf Goodman under Saks Global Enterprises.

But Saks’ plan to revive the company just put it in more debt. By May, Bloomberg reported, bondholders faced more than $1 billion in paper losses. Paper losses is the amount of money investors would lose if they sold their assets at current market prices.

When reached for comment about a possible bankruptcy filing, Saks told The Independent, “Together with our key financial stakeholders, we are exploring all potential paths to secure a strong and stable future for Saks Global and advance our transformation while delivering exceptional products, elevated experiences and personalized service to our customers.

“Importantly, opportunities in the luxury market remain strong, and Saks Global continues to play a distinct and enduring role within it.”

While Saks remains optimistic about its future, it must make interest payments of more than $100 million by December 30, according to data collected by Bloomberg.

The company is also considering raising emergency financing or selling assets to come up with quick funds, Bloomberg’s sources said.

Saks Fifth Avenue and Neiman Marcus have been around since the early 20th century.

While Saks Fifth Avenue and Neiman Marcus still have 41 and 36 stores in the U.S., respectively, there’s been a gradual decline in the popularity of department stores in recent years, partly because of a shift to online shopping.

Saks Off 5th, Saks Fifth Avenue’s sister discount retailer, will be reportedly closing its flagship store in New York City’s Upper East Side on December 31. There are currently 100 Saks Off 5th stores in the U.S. and Canada.

The company will also be shuttering nine other Saks Off 5th locations across the country beginning in January, which it told USA TODAY would enable it to “place greater attention to our high-performing and high-potential store locations, and refinements across our store footprint.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks