Trump’s tariffs are now being passed on to American consumers, businesses warn

‘Cost pressures due to tariffs were a consistent theme across all Districts,’ the Federal Reserve said

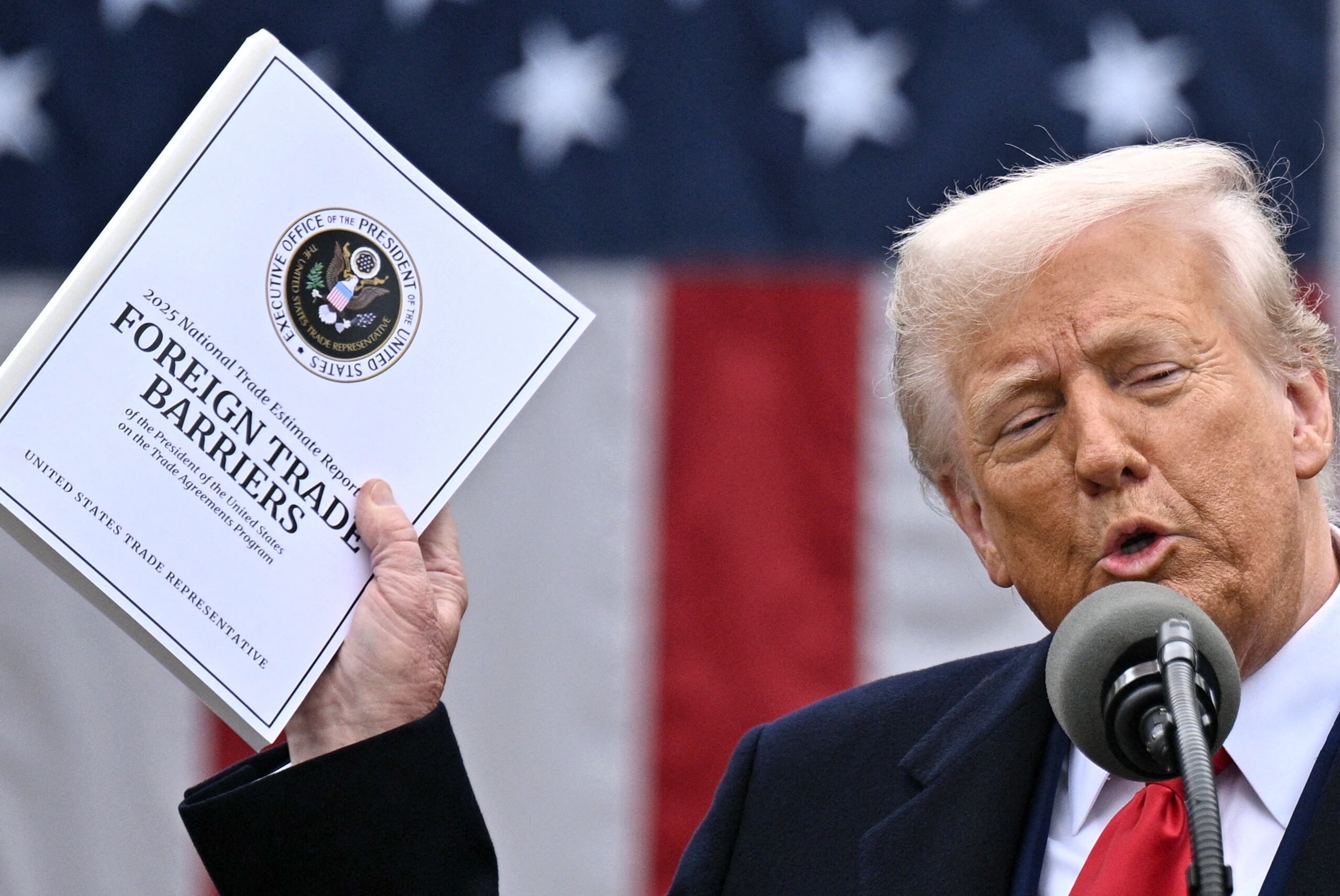

While the Trump administration has dismissed the idea that the president’s tariffs would raise prices, thousands of U.S. businesses are telling a different story.

The latest “Beige Book” from the Federal Reserve - which tracks economic conditions across much of the country - found that businesses are starting to pass tariff costs on to consumers, now that their pre-tariff inventory has been cleaned out.

“Cost pressures due to tariffs were a consistent theme across all Districts,” the Federal Reserve wrote in the January report.

“Several contacts that initially absorbed tariff-related costs were beginning to pass them on to customers as pre-tariff inventories became depleted or as pressures to preserve margins grew more acute.”

Low- to middle-income consumers are becoming “increasingly price sensitive and hesitant to spend on nonessential goods and services,” the report noted.

Since Trump announced tariffs for dozens of countries on “Liberation Day” in April, price increases have caused deep anxiety for consumers, and the economy more broadly.

By October, 37 percent of companies were passing tariff costs along to the consumer, according to a report from Goldman Sachs.

Because tariffs continue to hamper margins, the cost of goods and services is likely to remain high, though some businesses believe the rate at which prices are increasing will slow slightly, the Fed report noted.

“Looking ahead, firms expect some moderation in price growth, but [anticipate] prices to remain elevated as they work through increased costs,” the Fed wrote.

That price moderation is likely to emerge at different times across various goods and services. For example, the Fed noted that, while most tariffs on coffee have been lifted, coffee roasters likely won’t lower the cost of their products until they sell all their tariff-era inventory.

The January “Beige Book”, one of eight published each year, also held some good news. Economic activity was up in the regions surrounding the cities where the Fed has banks - San Francisco, Dallas, Atlanta, and New York, for example - marking a departure from the stagnant economic growth found in the past three reports.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks