Economic Studies: If you want to know what US 'soft power' is, look at Twitter

The stunning aspect of Twitter is how the US keeps changing the world

The Twitter tale has three elements to it. Two are obvious and are receiving huge publicity: the story about money and the story about societal change. The third is less celebrated but just as important. It is about the way the United States influences the world.

The money story is fascinating for all the usual reasons. Investor demand pushed up the price range at which shares will be issued, giving a valuation of some $17bn when trading begins later this week. Even in these days of devalued dollars, that is a lot for a company that has yet to make a profit. It is also a lot for a business that was founded as recently as 2006, demonstrating how quickly an idea whose time has come can flash around the world.

It is a tribute to US capitalism that is possible to create and fund businesses such as this; that the system is resilient and forward-looking enough to bear losses for many years in the hope that there will indeed be gold at the end of the rainbow. And if a group of young Americans have made fortunes out of it, they deserve to.

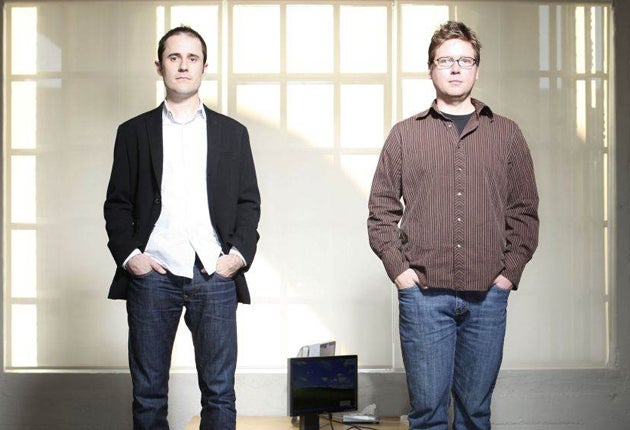

We are still adjusting to the societal changes that Twitter is bringing. No one knew quite what it was for. Biz Stone, one of its founders, told me of the moment when he realised they were on to something big. A few of them had agreed to meet at a bar in the Bay Area and when they got there it was rather crowded. So someone tweeted to a couple of people that they should try another bar. By the time they got there, there were 300 people outside it. The tweets rather defeated the object of the exercise but it showed the power of the information. So Twitter evolved less as a social network, which already existed, and more as an information network.

That has led to new issues. Here in Britain there was confusion over the legal position on libel, which had to be clarified with a little help from the wife of the Speaker of the Commons. There is the problem of filtering the wave of information in the half a billion tweets a day: the “What is signal, what is noise?” question. And there are darker sides, including criminality.

All this is as you would expect, and Twitter use will continue to evolve, not least because more commercial applications will be developed. I suppose the hardest question to answer is whether this and other new media developments really shape social change, or whether they reflect and facilitate what is already happening. What is beyond dispute is that Twitter demonstrates the economic concept of revealed preference: people reveal what they really want to do, by choosing to do something – they are not tweeting because they need to or because some advertiser has persuaded them to.

But the really stunning aspect of Twitter is the way American society keeps throwing up technologies that change the world. And mostly one part of the US. Again and again it is a group of people in California who keep doing it – from operating systems for computers, to commercial use of the web, to Google, to tablets, to Facebook, to this. The rest of the world gets the benefit.

It is a form of “soft power”, the expression coined by Joseph Nye of Harvard to express the ways in which US influence goes beyond its military muscle. But it not deployed by the US to increase its standing. These are technologies that the US has in effect given the rest of the world, in some cases free, or almost free. If it is soft power, it is also huge generosity and people should perhaps acknowledge that a little more than is sometimes evident.

Remember who it was who saved the Co-op

So the Co-op Bank is to be rescued by a group of investors led by American hedge funds. Not the parent Co-operative movement; not conventional UK financial institutions; not another British bank; not a Middle Eastern sovereign wealth fund; not, mercifully, the British taxpayer. There will be 12 hedge funds in all, and they will end up with some 35 per cent of the bank’s equity.

That says something quite profound about who in the world is prepared to take on risk. You might imagine that there would be investors in Britain who would see the chance of a profit and be prepared to invest. After all, the Co-op Bank is an established brand, with a reputation for ethical banking, and the UK is a favoured location for investors. The economic cycle seems to be turning up, so the timing is in favour. But the harsh truth is that it is hedge funds that are prepared to step up to the plate.

There is a lesson here for us all. If the Co-op Bank is restored to health, as we should all hope it will be, and as a result the hedge funds make a sizeable profit, remember that no one else was prepared to take on the challenge.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks