Our outrageous tax system isn’t just bad economics. It’s immoral too

We shouldn't tax people who earn less than they need to live

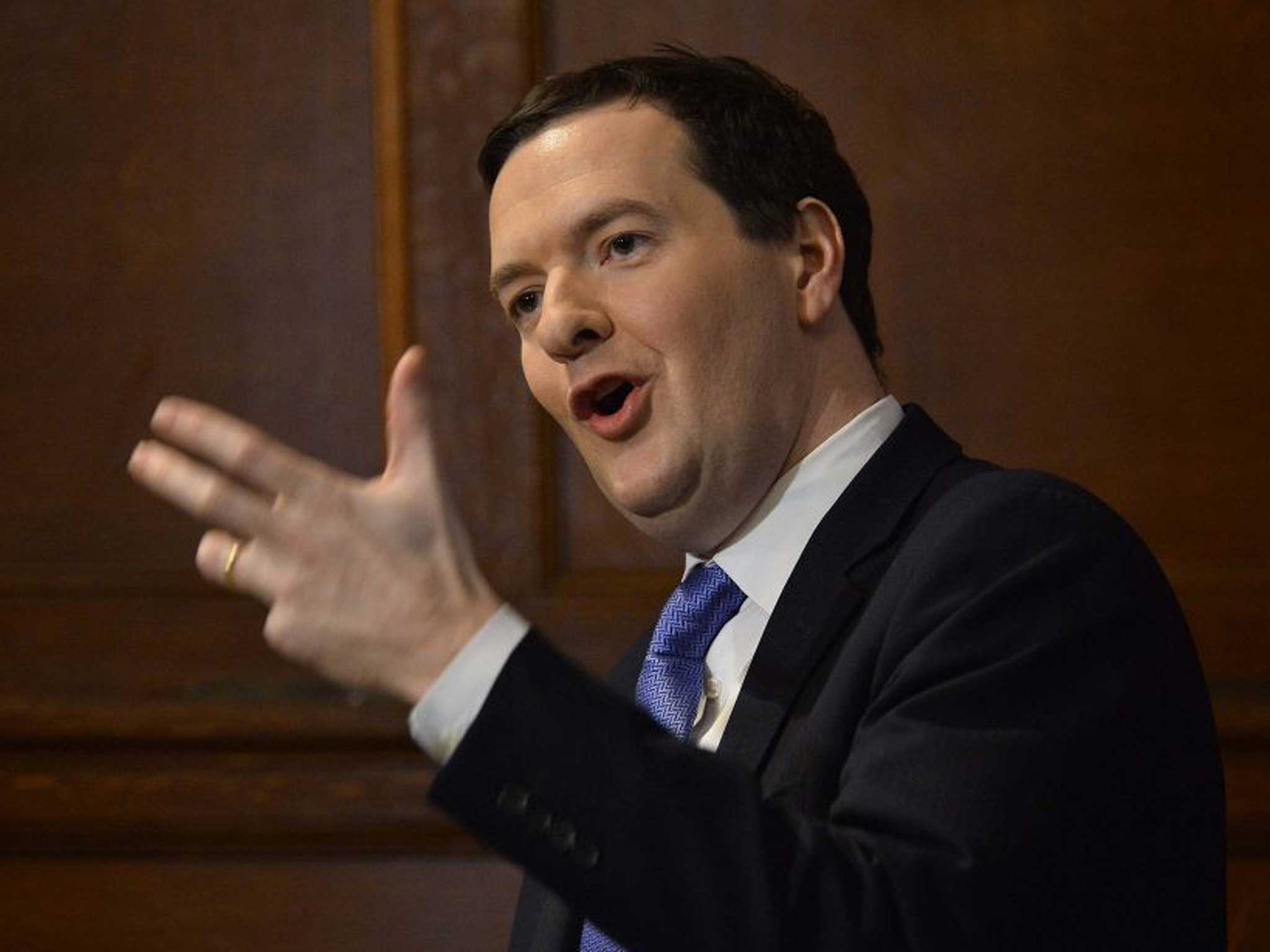

Ukip believes in opportunities. And just as we believe that the best people to govern this country are the British people themselves, we also think they are the best at managing their own money and keeping the economy on an even keel. As George Osborne delivers his Budget today, that’s the message I want to get across.

Successive governments have shown that they have little grasp on our economy beyond short-term headline-grabbing policies which barely scratch the surface of the structural problems facing UK plc. Six years on from the financial crash of 2008, which was predicted by many and ignored by our leaders, we are still running a budget deficit. This is adding to our national debt and burdening the taxpayer with a lifetime of bills which they will have to pass on to their children and grandchildren. This is the economics of greedy politicians and newspaper commentators, not experienced professionals.

Many years ago it was Ukip’s ambition that everyone earning the minimum wage should be taken out of income tax altogether. Naturally the ambition was met with derision and scorn. Fancy saying fewer people should pay taxation! If people don’t have enough money to live on they can apply for tax credits and allowances, paid from their own taxes of course after a hefty batch of admin costs and box-ticker salaries have been deducted.

Credit where credit is due, the Liberal Democrats did see some sense in taking the poorest earners out of the tax cycle. But not as much sense as Ukip sees. My party thinks it is a nonsense that people earning the minimum wage of £6.50 an hour still have tax deduced at source. It is this party’s ambition that no one earning the minimum wage should pay income tax. Not only is it a bureaucratic waste, it also discourages people from getting into work when the “safety net” of the welfare state has become a goose-down duvet.

The living wage has been estimated at £7.65 an hour outside London, where house prices and living costs are considerably higher than the rest of the country. To tax people who earn less than they need to live on is, in my opinion, immoral.

But we would go further than that. I want to see an end to the fiscal drag which has been created by holding back the earnings thresholds as inflation increases. This has resulted in people who have worked hard in their chosen professions – often vocational – paying the tax rates which were designed for the very top earners. It means nurses, teachers, police officers and soldiers are paying the same top level of tax as judges, bankers and even the Prime Minister. But of course just as with inheritance tax, the very rich can afford advisers to make sure that they don’t pay the amount of tax they could be billed.

The higher rate of tax was supposed to be for high earners, and now in London and the South-east the higher rate of tax has clawed in a lot of people who are far from what would be described as high earning. It is a policy which started with the Labour Party and continued with this Government and those who are earning more than £41,000 a year are suddenly finding that if they have got a couple of children they are paying a marginal rate of tax of near 70 per cent.

As Ukip’s economics spokesman Steven Woolfe has stated, “the range of those people is from just over £41,000 to just shy of £150,000, and that range is too big. They are paying more on their train fares, more on their gas and energy bills and they have also been impacted by child benefit.” The Chancellor has allowed rail season-ticket prices to massively outstrip general inflation, hitting commuters hard, particularly those travelling into London. That’s why we propose that the threshold to start paying the higher rate of tax is raised to an initial level of £45,000. Because it seems to me that the current policy is nothing more than a “London and the South-east” tax on workers.

Since the Coalition came to power another 1.4 million hard-working people have been pulled into the 40 per cent tax bracket. Mr Osborne lowered the threshold from £43,875 total earnings to £41,450. Nearly 4.5 million people are now paying tax in a bracket that in the Thatcher era was thought only suitable for the very well off.

The Tories have often marketed themselves as the party of fair taxation and hard work. But the fact is those in Westminster have dragged people into a spiral of excessive taxation, ripping the heart of the productivity of our economy and our opportunity to grow. Indeed, George Osborne has shown how utterly removed from reality he is by insisting that people actually welcome being pulled into paying a higher level of tax.

Ukip is the party that wants to make work pay. We want to put money back in people’s pockets, not line the suits of bloated government departments and quangos.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks