Surprise, surprise: real wages have gone nowhere. People should have listened to the real experts

Britain’s labour market is highly flexible – employment has risen but average real wages have fallen

As expected, nominal wages declined this month. In fact the National Statistic Average Weekly Earnings (AWE) fell by 1.7 per cent on an annual basis through April 2014 for the economy as a whole.

The AWE dropped by 2.3 per cent in the private sector, 1.8 per cent in services, 6.1 per cent in finance and business services and 4.6 per cent in construction. Over the same period the RPI grew by 2.5 per cent and the CPI by 1.8 per cent, so real wages fell by 4.2 per cent using the former as a deflator and 3.5 per cent using the latter. Real wages in the private sector were down 4.8 per cent using the RPI and 4.1 per cent using the CPI. It turns out this isn’t simply a statistical mirage.

Suddenly those claiming real wages were rising have been left with egg on their faces. For example, on 14 May an editorial in the Financial Times claimed “real wages are on the rise for the first time since 2010, signalling that living standards are finally improving for some Britons”.

An editorial in The Times on 16 April declared that real wages were on the rise which “will vindicate the Coalition’s broad strategy of reining in the state while coaxing the private sector back to growth. It will vindicate the Bank of England’s strategy of holding down interest rates even as unemployment falls, and it will further erode the battleground labelled ‘living standards’ on which Ed Miliband hoped to fight the next election.”

Presumably falling real wages don’t vindicate the Coalition’s strategy of reining in the state and help Ed Miliband’s battleground claim that living standards have fallen, as they continue to do. I wonder if the two papers will write a retraction given the new falling real wage numbers? Don’t bet on it.

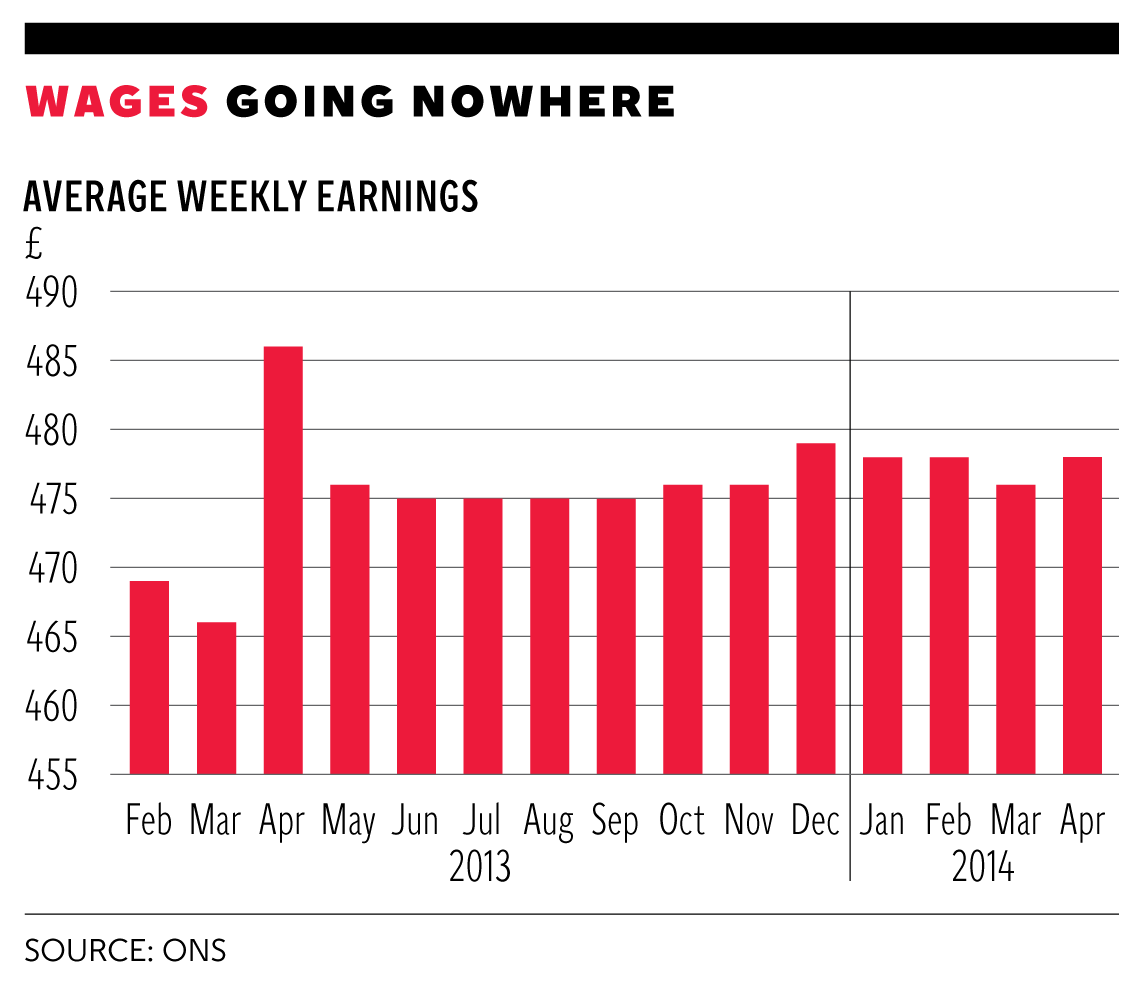

False claims by the Tory spinners, that real wages are rising, was largely based upon data for February and March of 2014. The chart presents the AWE for each month from February 2013 and makes clear the rush to judgement that people made was based on a few highly unusual outlier months. This month’s big fall in real earnings arose because of the spike in earnings in April 2013. Workers moved their bonuses to the 2014 tax year because of an early announcement of lower tax rates.

But this also had the effect of artificially lowering earnings in February 2013 and March 2013, which had the effect of boosting nominal wage growth in February 2014 to 1.8 per cent and 2.1 per cent in March 2014. With CPI inflation of 1.7 per cent and 1.6 per cent respectively in the two months, hey presto! real wage growth had become positive, although not if you use the RPI, which was 2.5 per cent.

Using the CPI as a deflator, in the seventy-one 71 months for which we have data since May 2010 there have been only three months of positive real wage growth, February and March 2014 and April 2013, and only April 2013 using the RPI! But this was not going to last. The AWE has gone up from £449 in May 2010 to £478 in April 2014 or 6.46 per cent. Over the same time period the CPI grew from 114.4 to 128.1 or 11.98 per cent, so real wages have fallen by 5.5 per cent. Using the RPI, which is up 14.36 per cent, they have fallen by nearly 8 per cent.

The chart makes clear that there is little likelihood of real wage growth rising in the months ahead. We have 11 months of data since then and they are as flat as a pancake. Wages in April 2014 are up 1 per cent in the 11 months since May 2013 and are actually slightly lower in April 2014 than they were in December 2013.

Jeremy Warner in The Telegraph on 14 June argued that the declines in real wages “baffles the experts”. Not me. It also didn’t baffle the Nobel economics laureate Sir James Mirrlees, who explained why in a speech last week at the Macquarie Graduate School of Management in Australia. He argued that because of globalisation there was little reason to expect real wage growth, principally down to flows of capital, which means that “owners of capital get more and workers get less. Certainly if you’re looking at it from the point of view of a country like Australia, USA, Hong Kong, Britain, then that seems to be the way of it. Of course if I’m right that wages will get equalised that would mean that wages in China, India would be higher but it looks to me that they’d be much lower in Australia and the USA than people are hoping.”

Mirrlees went on to suggest that the alternative to weak wage growth was higher unemployment. “Capital can increasingly leave the rich countries and so long as wages are higher than in the poorer countries that seems the way it should go. I should just emphasise that this theory says that it’s all wages, any particular skill level, unskilled, skilled, professional, chief executives. We are the future. So long as countries resist this force then of course we’ve got to think of the consequences. If you try to hold it back, if you try to keep the wages high, then that’s going to mean growing unemployment.”

The performance of the highly flexible UK labour market isn’t really a puzzle. Employment has risen and unemployment has fallen because wages have been especially flexible downwards.

A worker’s wages buy around 5 per cent less today than they did when the Coalition took office. In response to the latest labour market data the shadow Work and Pensions Secretary, Rachel Reeves, trotted out Labour’s usual mantra: ‘Working people are over £1,600 a year worse off than when David Cameron came to office and pay has fallen behind inflation.”

This line doesn’t seem to resonate with people. It makes more sense to focus on the integral which people can understand. When the 2015 election comes Labour’s central message should surely be “you are 5 per cent worse off under the Tories than you were in May 2010”.

Labour would be wise to adopt Mirrlees’s suggested solution of subsidising low wage work by raising taxes on high wage workers and capital incomes. It’s time for Labour to be brave.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies