Meet the money coach: from salary to savings, discover simple tips to boost financial security

From giving greater freedom in terms of careers and education to boosting everything from self-esteem to relationships, it’s clear that finances are key to equality. Here we explore the key issues hindering women’s economic empowerment, and effective strategies to tackle them

When it comes to mottos and mantras, money gets something of a bad rap: it can’t buy you happiness or love, while the best things in life are apparently free. But the truth is, while money can’t guarantee contentment by any means, managing and understanding it can have a huge impact on many different areas of your life. From the freedom to pursue career and education goals or personal dreams, to allowing you to make key life changes and feel secure if things don’t go to plan, financial security provides a foundation to build on and thrive from.

Although we might not consider ourselves ‘money people’, be driven to earn a certain salary, or find the whole topic confusing, stressful or scary, money impacts almost every aspect of our lives, and it’s vital – however big or small our bank balance – to engage with our financial situation, and develop healthy behaviours around it.

Unfortunately, the cost of living crisis, combined with a number of gender-based issues is making the financial outlook for young women extremely tough. From bills and food prices reaching record highs, to ballooning rents and student loans setting up a life-time of debt, hundreds of thousands of young people are at the sharp end of a multi-pronged crisis.

It’s no wonder that a study by cross-party think tank Demos found that Britons aged 18 to 30 are worst affected by the cost of living crisis. The combination of high property prices and soaring rents means few young people can get on the property ladder: in 2021, UK renters spent an average of 23 per cent of their income on rent. Right now, circumstances feel insurmountable and hard to ignore – 53 per cent of young people perceive their career prospects are worsening and although 72 per cent see the sense in saving, 47 per cent said they had too much debt, or couldn’t pay the bills in the event of a financial shock.

Financial inequality

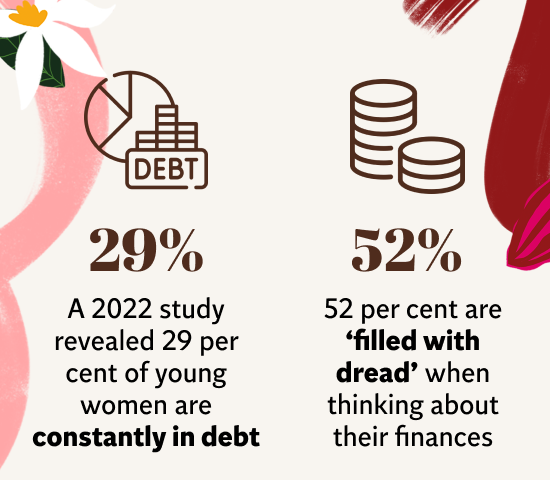

Unsurprisingly, all this pressure is triggering a lot of financial difficulty and insecurity. In a 2022 survey, Young Women’s Trust – a charity that campaigns for an equal world of work for young women – found that 29 per cent of young women are constantly in debt, while 52 per cent are ‘filled with dread’ when thinking about their household finances.

As Claire Reindorp, CEO of Young Women’s Trust, explains, the rising cost of living is having a disproportionate impact on young women as they earn less to begin with. “For too long young women have been paid less than young men – earning on average a fifth less each year. Not only do young women get paid less, but they also face barriers to employment such as inflexible working, costly childcare, and they often encounter workplace discrimination that prevents them from thriving in their careers.”

“This financial inequality which starts so early in working life sets off a spiralling effect – women earn less, so are more likely to be in debt, more likely to be stuck in poverty, more likely to be on benefits, and doing more childcare and other unpaid work. This gap accumulates over a lifetime, ending up in a pensions gap of around 35 per cent. In this context, it’s even more important for young women to feel financially confident, yet sadly, even harder. All too often they are stuck in ‘any job’ – not a job that they enjoy or thrive in or that fulfils their potential – because of the need to make ends meet or because making a move might mean they lose out on important things like flexibility.”

The Young Women’s Trust report revealed that over a third of young women said they have taken on new debt in the last year, compared to only a quarter of young men. “With all this pressure, young women’s mental health is suffering, as well as their confidence and self esteem, Reindorp reveals. “They tell us that they’re missing out on seeing their friends because they simply cannot afford to eat or heat their homes.”

Many of those supported by Young Women’s Trust have been hugely affected by the cost of living crisis, which has taken its toll on everything from their career and earning potential, to their living situation and their mental health. Amy, 29, a mental health advisor who lives in a remote town in Wales, says: “The crisis is really impacting on my future. My ultimate goal is to become a mental health professional, however, to achieve this, I’m having to spend three hours each day travelling to an office in a nearby city to get experience in the field.”

For Amy, this is both a mental and financial drain. “I’ve been working to the point of burnout for a housing deposit, or enough money to rent short term closer to the city centre. But now, with the new rise in interest rates, that feels even further out of reach.” Her travel to work eats up a third of her salary, while rising prices of everything from food to bills makes saving incredibly tough. “Because of this I’m not seeing friends as often because I can’t justify the costs.”

A fairer way forward

So how can we start to tackle the financial inequality young women face, and help build a fairer future? “Firstly, we want the government to do more to tackle the income gap that young women face,” says Reindorp. “We want them to prioritise support during the cost of living crisis by extending the national living wage and increasing it to cover the rising cost of living. We also want them to ensure the benefits system offers support for young women to move into jobs that allow them to thrive.”The charity also advocates for changes in the workplace.

“There are lots of ways employers can help create an equal world of work for young women,” Reindorp says. “Companies can start by having transparent pay scales, offering flexible working, ending zero hours contracts, offering the Living Wage, and providing meaningful development opportunities for young women. What’s more, it makes business sense. Society loses an estimated £28.2bn a year by trapping young women in low paid, insecure work and making the workplace inaccessible for young women with caring responsibilities.”

Conversely, boosting women’s financial security via better pay and opportunities has benefits for everyone, as Reindorp notes. “At Young Women’s Trust our vision is to create an equal world of work for young women and to ensure they are paid fairly for the work they do – where they are valued, can make choices and look forward to a fairer financial future. Greater financial security will enable young women to thrive and fulfil their aspirations, which in turn will see this huge talent pool helping to boost our economy.”

Power-up tips: How to boost financial security

Take control

While it can feel difficult to tackle your money situation, particularly when you have other life pressures to deal with, there is a wealth of instantly accessible and easy-to-use resources that will allow you to quickly take control, helping you manage your money, discover any benefits and funding you are entitled to, and get support from experts whose job it is to help improve your financial circumstances. The ‘Help With Your Money’ section of Young Women’s Trust website aggregates free, easy-to-use tools, sites and organisations that can provide practical support. This includes emergency funds, benefit and budget calculators, debt assistance, as well as grants for everything from bills and household items to studying.

Open up

We’re brought up not to talk about money, but this stigma makes it even harder to cope when we’re struggling with our finances, poor pay or spiralling bills. ‘The Lounge’ is Young Women’s Trust’s private Facebook group, where you can connect with other young women with similar experiences, share useful links and tips, take part in discussions and surveys, enter competitions, and find out about opportunities like events, training or volunteering. As Reindorp explains, connecting young women is vital to making real, concrete change to their financial circumstances. “Via our growing network, we can mobilise young women to call out discrimination and support each other to challenge inequality.”

Call on a coach

Young Women’s Trust also helps young women by providing coaching and support to help boost their career prospects and empower them financially. ‘Work It Out’ is a free service the charity offers to women aged 18 to 30, which aims to unlock their potential by building the knowledge, networks and self-belief needed to navigate the world of work. Users can sign up for coaching, help with their CV and job applications, or both, with sessions held over phone, WhatsApp or email.

Galaxy® is committed to help one million people, including women, their families and communities thrive by 2030 via its ‘Your Pleasure Has Promise’ manifesto and vital initiatives including the Women for Change programme in collaboration with CARE and their How to Thrive series in partnership with Young Women’s Trust. Click here to find out more

Bookmark popover

Removed from bookmarks