Spring Statement 2022: Sunak raises NI threshold as OBR warns families face record fall in real income

Chancellor hails his ‘largest ever tax cut’ as OBR projects ‘biggest fall in living standards’ on record

Rishi Sunak has delivered his mini-Budget to give people a helping hand with their finances as inflation hits a 30-year high.

The chancellor announced a 5p fuel duty cut and a rise in the National Insurance threshold by £3,000. He also announced that the OBR expects inflation to rise further this year, to 7.4%.

The rate of Consumer Price Index inflation jumped to 6.2 per cent in February, from 5.5 per cent in January, the ONS said on Wednesday morning.

People will have an extra £3,000 that they will not pay national insurance on, under the “largest ever” tax cut announced by Mr Sunak.

He said the government’s cut to fuel duty would represent the “biggest cut to fuel duty rates ever”. Labour criticised Mr Sunak for “not understanding the scale of the challenge.”

The Office for Budget Responsibility revealed that the rise in inflation to a predicted 40-year high this year would trigger “the biggest fall in living standards in any single financial year since ONS records began in 1956-7”.

That’s all from The Independent’s live coverage of the spring statement for now.

Check back on our site tomorrow for more on the fallout of the chancellor’s announcements.

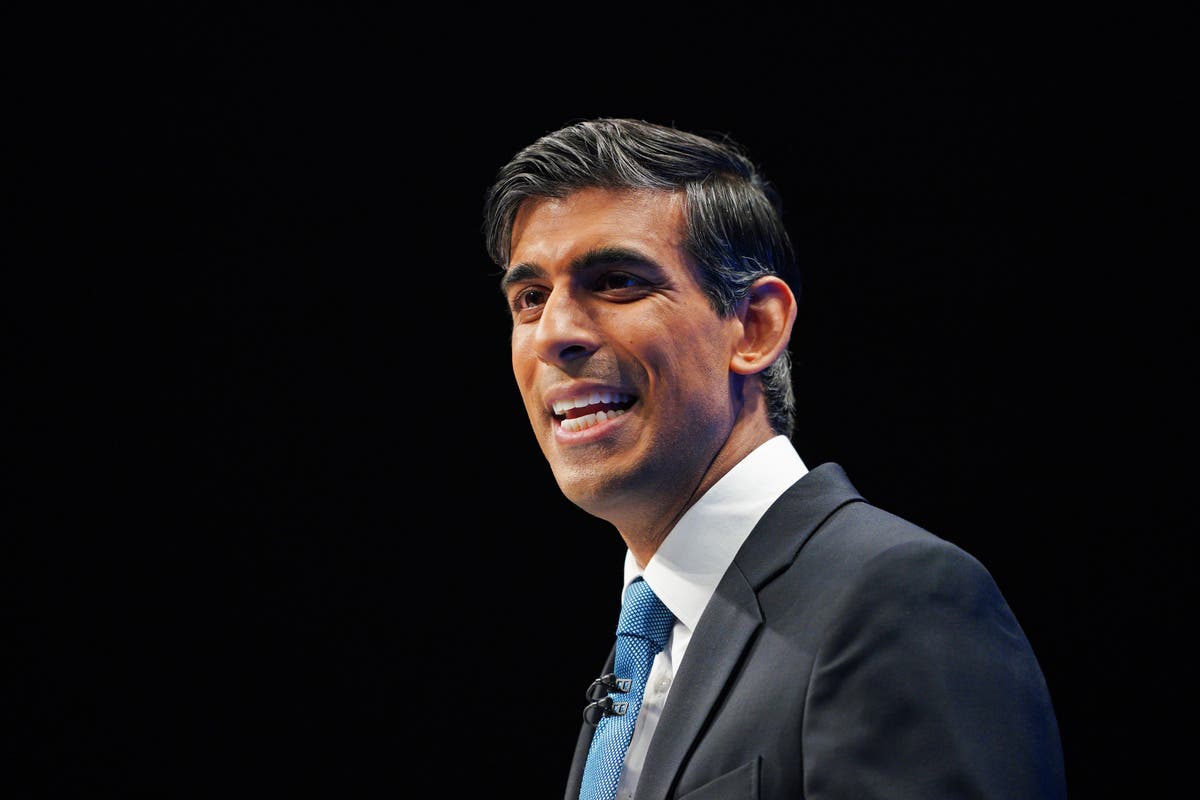

Chancellor pictured preparing for the Spring Statement

Chancellor Rishi Sunak has been photographed preparing for the Spring Statement, which starts at 12:30 today.

In a post on Twitter, Mr Sunak said he was “delivering greater economic security for our people, accelerating growth and productivity, and making sure the proceeds of that growth are shared fairly.”

He added: “That is not the work of any one statement. But that work begins tomorrow. The Spring Statement starts at 12:30”.

Last minute changes to today’s mini-Budget

Chancellor Rishi Sunak order last minute changes to Wednesday’s mini-Budget after being warned he faces a “moment of truth” this week on the cost-of-living crisis, Political editor Andrew Woodcock and Economic editor Anna Isaac write.

The Independent has learnt that the Office for Budge Responsibility has been told to recalculated fiscal forecasts to take into account amended Treasury plans, a highly unusual move.

Read the full story here:

Sunak orders last-minute changes to Wednesday’s mini-budget

Chancellor has ‘wiggle room’ to help tackle cost of living crisis, economist says

A leading economist has said that chancellor Rishi Sunak has “wiggle room” to help tackle the rising cost of living.

Sir Charlie Bean told the BBC that rising inflation and improved tax receipts would give Mr Sunak some more “wiggle room” at today’s Spring Statement.

According to new figures, the government collected £53.7bn in taxes this February, up by more than £4bn in comparison with last year.

Sir Charlie Bean, who used to be responsible for economic forecasts at the Office for Budget Responsibility, suggested that this would give Mr Sunak between £25bn- £50bn to “play with” in his mini-Budget.

ICYMI: Labour has called on Rishi Sunak to reverse the National Insurance Hike

Labour has called on Rishi Sunak to use his mini-Budget to reverse the government’s planned 2.5 percent hike in National Insurance contributions.

Shadow chancellor Rachel Reeves said that Labour would not go ahead with the rise - made up of 1.25 percent each on employers’ and employees’ payments.

Conservative MPs have also piled pressure on the Chancellor to rethink the tax rise, including minister Jacob Rees-Mogg who called for it to be halted.

Voters want Sunak to ditch NI rise and tax North Sea energy giants, poll shows

Voters overwhelmingly support a windfall tax on North Sea oil and gas companies to support families with unprecedented hikes in energy bills, according to a new poll for The Independent.

And the Savanta ComRes survey also found majority support – including among Conservative voters – for Rishi Sunak to scrap next month’s 1.25 percentage point rise in national insurance contributions (NICs), cut fuel duty, and introduce a £10-an-hour minimum wage.

The findings put increased pressure on the chancellor to deliver help in today’s mini-Budget for households facing what Money Saving Expert’s Martin Lewis has described as a “fiscal punch in the face” from soaring prices.

Andy Woodcock, has more on the findings of the exclusive poll here:

Voters want Sunak to impose windfall tax on energy firms in mini-budget, poll shows

What will Rishi Sunak do to help ease the cost-of-living crisis?

Rishi Sunak has tough choices to make on how he will deal with a deepening cost-of-living crisis, with pressure mounting from all sides to deliver significant support for struggling families, Ben Chapman writes.

The chancellor has £24bn more to spend than had been forecast a few months ago, official figures released on the eve of Wednesday’s spring statement show.

Some of the options Mr Sunak has to help families including scrapping the national insurance increase, cutting VAT on energy bills, a windfall tax on energy company profits and a 5pm fuel duty cut.

Read about the likelihood of these decisions here:

Spring statement: What will Rishi Sunak do to help ease the cost-of-living crisis?

Chancellor could cut fuel duty later today - The Sun reports

Rishi Sunak is expected to slash fuel duty in his Spring Statement today, The Sun have reported. MPs think that the chancellor could cut the tax by as much as 5p in response to soaring prices at the pump.

The average price of petrol has shot up to an all-time high of 165.37p a litre, an increase of more than 55% in the last two years. Diesel has also risen to 177.47p per litre, government figures show.

The government has insisted that there will be no rethink on the £12bn national insurance hike, MailOnline reported. But a fuel duty cut looks more likely, according to commentators.

Rishi’s ‘got more cash than he expected’, economist from Institute of Fiscal Studies says

Economist Paul Johnson, from the Institute of Fiscal Studies, has said Rishi Sunak has a choice between spending extra cash in the near term to ease some of the cost-of-living crunch or sticking with the spending he already set out last year.

“He’s got more cash than he expected. The downside is that that extra cash can buy less stuff because of all the inflation that is around.” Paul Johnson said.

“His big choice is about whether he uses the extra cash on other things, like the cost of living crisis, or do what he said he was going to do last October.

“We need to distinguish between the short term and long term. He’s got money he can spend on short term cost of living crisis issues, if this is (and it increasingly looks like it) a long term increase in the cost of living and long term reduction in growth, he can’t support us through that for ever. We are just economically worst off.

“He cannot protect us forever but he can spend a lot of money in the coming year to smooth the difficulty of the cost of living in the near future.”

Breaking: Inflation rises to 6.2% in February from 5.5% in January, ONS says

Breaking: Inflation rises to 6.2% in February from 5.5% in January, ONS says

Grant Fitzner, chief economist at the Office for National Statistics (ONS), said: “Inflation rose steeply in February as prices increased for a wide range of goods and services, for products as diverse as food to toys and games.

“Clothing and footwear saw a return to traditional February price rises after last year’s falls when many shops were closed.

“Furniture and flooring also contributed to the rise in inflation as prices started to recover following new year sales.

“The price of goods leaving UK factories has also been rising substantially and is now at its highest rate for 14 years.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks