UK still a safe haven for dirty money, study finds

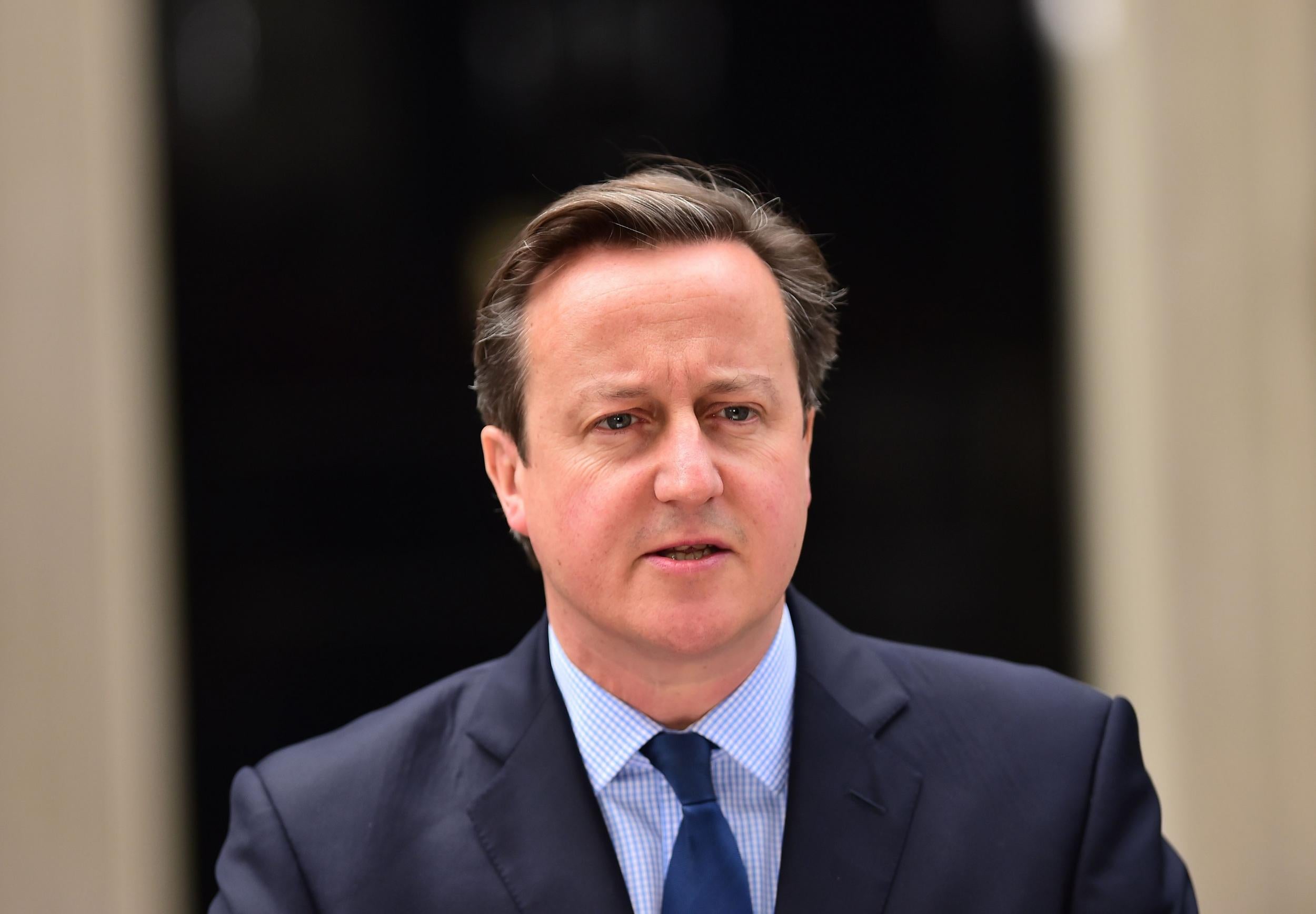

David Cameron repeated his commitment to keeping out money-launderers in the wake of the terrorist attacks in France

The world’s leading anti-corruption organisation has called on the British Government to scrap the “mish-mash” of supervisory bodies aimed at preventing money-laundering because they are “woefully inadequate,” and allowing billions of pounds of corrupt money to be hidden in the UK.

Transparency International (TI) has declared that a complete overhaul of Britain’s systems is needed to prevent dirty money coming in from corrupt foreign officials who find Britain a soft touch. With Britain’s huge financial services industry, expensive property market and art and luxury goods suppliers, it is a magnet for foreigners looking to make their stolen money disappear.

There are 22 supervisory bodies – mostly trade and professional associations – overseeing the gatekeeper industries through which most cash is laundered: financial services, law, accountancy, property, luxury goods and trust and company service providers. Of those, only one appears to be enforcing the rules to a level above “low” or “unreported”. TI today called for them to be stripped of their anti-moneylaundering supervisory roles and replaced by a single, well-resourced, “super” supervisor.

David Cameron repeated his commitment to keeping out money-launderers in the wake of the terrorist attacks in France. But TI says the system in place is not fit for purpose. Rachel Davies, senior advocacy manager for the organisation, said: “Given that the Prime Minister has rightly said that dirty cash is not welcome in the UK, it is appalling that a shambolic system is failing to stop that flow.

“Corrupt individuals are still finding the UK to be a safe haven for their ill-gotten gains and the vast majority of institutions that are meant to prevent that from happening are not up to the job.”

The body says fines are too low to act as a deterrent and there was a conflict of interest among 15 of the supervisory groups as they are also lobbyists for the companies they are supposed to be watching over.

It says Britain is unique in leaving such supervision to a range of private sector bodies.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies