Jeremy Hunt eyeing cuts to public spending as recession deals blow to spring budget plans

The UK’s latest economic woes come just as voters in Kingswood and Wellingborough take to the polls

Jeremy Hunt could slash public spending by billions of pounds to fund pre-election tax cuts in next month’s budget.

Treasury officials are considering the cuts, which opponents say would load more austerity on to struggling public services.

The moves comes as Mr Hunt faces increasing economic woes on multiple fronts. Official statistics show the UK economy entered recession at the end of last year.

And Mr Hunt is understood to have been told by the official spending watchdog on Wednesday night that he has less room than expected at the start of the year to reduce taxes.

The Office for Budget Responsibility is thought to have warned there is around £12 billion of what is called ‘headroom’ down from £24 bn.

Shadow chancellor Rachel Reeves dubbed it “Rishi’s recession” as she said the prime ministercould “no longer credibly claim that his plan is working”, and that his “promise to grow the economy is now in tatters”.

Gross domestic product (GDP) fell by 0.3% in the fourth quarter, following a decline of 0.1% in the previous three months, according to the Office for National Statistics figures released on Thursday morning.

“This is Rishi Sunak’s recession and the news will be deeply worrying for families and business across Britain,” Ms Reeves said. “It is time for a change. We need an election now to give the British people the chance to vote for a changed Labour Party that has a long-term plan for more jobs, more investment and cheaper bills. Only Labour has a plan to get Britain’s future back.”

Economists said the recession is likely to be short-lived, with GDP expected to pick up from the start of 2024. But the figures are damning for Mr Sunak, who has vowed to grow the economy as one of his five priorities.

The statistics also show that GDP per person dropped every quarter of 2023, having now growth since Q1 2022 - making the longest unbroken run without per capita GDP growth since records began.

Mr Hunt said the contraction came off the back of high inflation and the recent run of interest rate rises, but insisted the economy was turning a corner. He said it was the “right thing to do” to prioritise tackling inflation.

The Chancellor said: “We always expected growth to be weaker while we prioritised tackling inflation, that means higher interest rates, and that is the right thing to do because you can’t have long-term healthy growth with high inflation.

“The underlying picture here is an economy that is more resilient than most people predicted, inflation is coming down, real wages have been going up now for six months.

“If we stick to our guns, independent forecasters say that by the early summer we could start to see interest rates falling and that will be a very important relief for families with mortgages.”

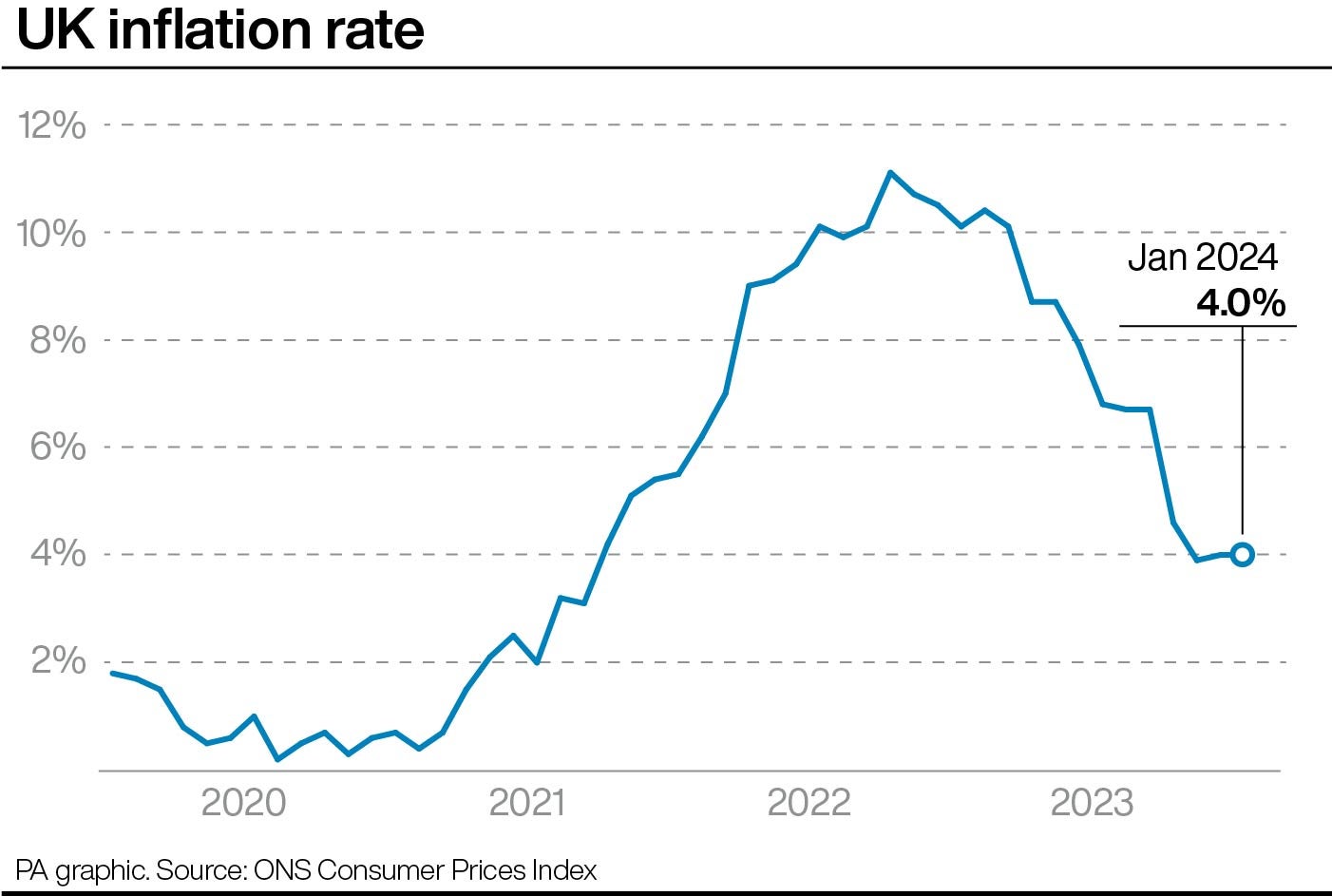

On Wednesday the prime minister had insisted the “economy has turned the corner” after figures showed inflation stayed at 4 per cent on the year in January, unchanged from December. Although double the Bank of England’s inflation target, it was better news than expected, after economists predicted a rise to 4.2 per cent.

Left-leaning think tank Institute for Public Policy Research said the economic recession should be a wake-up call for the government.

Pranesh Narayanan, research fellow at the Institute for Public Policy Research (IPPR) has said the figures underscore the need for public investment, rather than “irresponsible tax cuts”.

“This time last year, the Prime Minister pledged to get the economy growing but today’s data, showing a mild technical recession, shows a stark lack of progress,” Mr Narayana said. “Chronic underinvestment in hospitals, schools, net zero and infrastructure has created a crumbling public realm and a broken economy.

“This should be a wake-up call that spurs the Government to prioritise public investment rather than irresponsible tax cuts. Let’s fix our problems now rather than storing them up for later.”

The New Economics Foundation said it was “no surprise” the UK had fallen into recession, “given this government’s mismanagement of the economy and the Bank of England’s panicked interest rate rises”.

Dr Lydia Prieg, Head of Economics for the organisation said:

“This government’s long standing failure to invest in the economy combined with the Bank of England’s panicked interest rate rises have caused serious damage.

Ordinary people are suffering the effects of these decisions, with low wages and falling standards of living likely to plague us for years.

To combat this we need a drastic change in direction and serious government investment in green industries, public services, housing and skills.”

Asda chairman Lord Rose told BBC’s Radio 4 Today programme: “If it looks like a duck, it quacks like a duck, it walks like a duck, it's a duck. It's a recession. It doesn't matter whether it's a technical recession or not.”

He added: “I take no pleasure in saying there's no surprise here. We've got a low growth economy or a no growth economy. We've got very low productivity. We've got very stubborn and persistent inflation, which is still twice to the bank's target, and we have got 2.9 million people in this country who are economically active and yet we've got a tight labour market. It doesn't add up and we must now find a route to grow the country and we haven't found that route yet.

“Cutting your way to growth, in my view, as a businessman, is almost impossible.”

Martin McTague, national chairman of the Federation of Small Businesses (FSB), said news of the technical recession “will just confirm what many small firms have been saying for some time now – it’s very tough out there”.

He added: “The Government needs to foster an environment where small firms can grow, to the overall benefit of the economy, and to put this period of stagnation and shrinkage behind us once and for all.”

Joseph Rowntree Foundation chief economist Alfie Stirling said although business investment may be the “lifeblood” of the growing economy, public service and social security investment must “provide the heartbeat”.

He added: “Just weeks before the Budget, addressing this crisis of economic security, from individual families to the nation as a whole, must be the first priority for policymakers. This starts with reforming Universal Credit to reflect the actual cost of essentials, and a revitalisation of key services across care, housing, and job support.

Meanwhile, TUC general secretary Paul Nowak blamed the Conservatives’ “economic failures” for the technical recession:

“The Conservatives’ economic failures are hitting jobs and living standards. With household budgets at breaking point, spending is down and the economy is shrinking. At the same time our crumbling public services are starved of much-needed funding.

He added: “After being in power for 14 years, the Tories have driven our economy into a ditch and have no idea how to get out.

Liberal democrat leader Ed Davey said that “Rishi’s recession” has “savaged the British economy by decimating growth and leaving families to cope with spiraling prices.”

“Years of Conservative chaos and a revolving door of Conservative chancellors has culminated in economic turmoil,” he added. “It’s hardworking Brits forced to pick up the tab for this mess, through high food prices, tax hikes and skyrocketing mortgage bills.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks