Everything to know about the Trump Organization tax fraud trial

‘The idea that Trump didn’t know is going to be the critical thing that Weisselberg is asked about,’ former federal prosecutor says

The Trump Organization, former President Donald Trump’s eponymous real estate business, is going to trial on charges of criminal tax fraud.

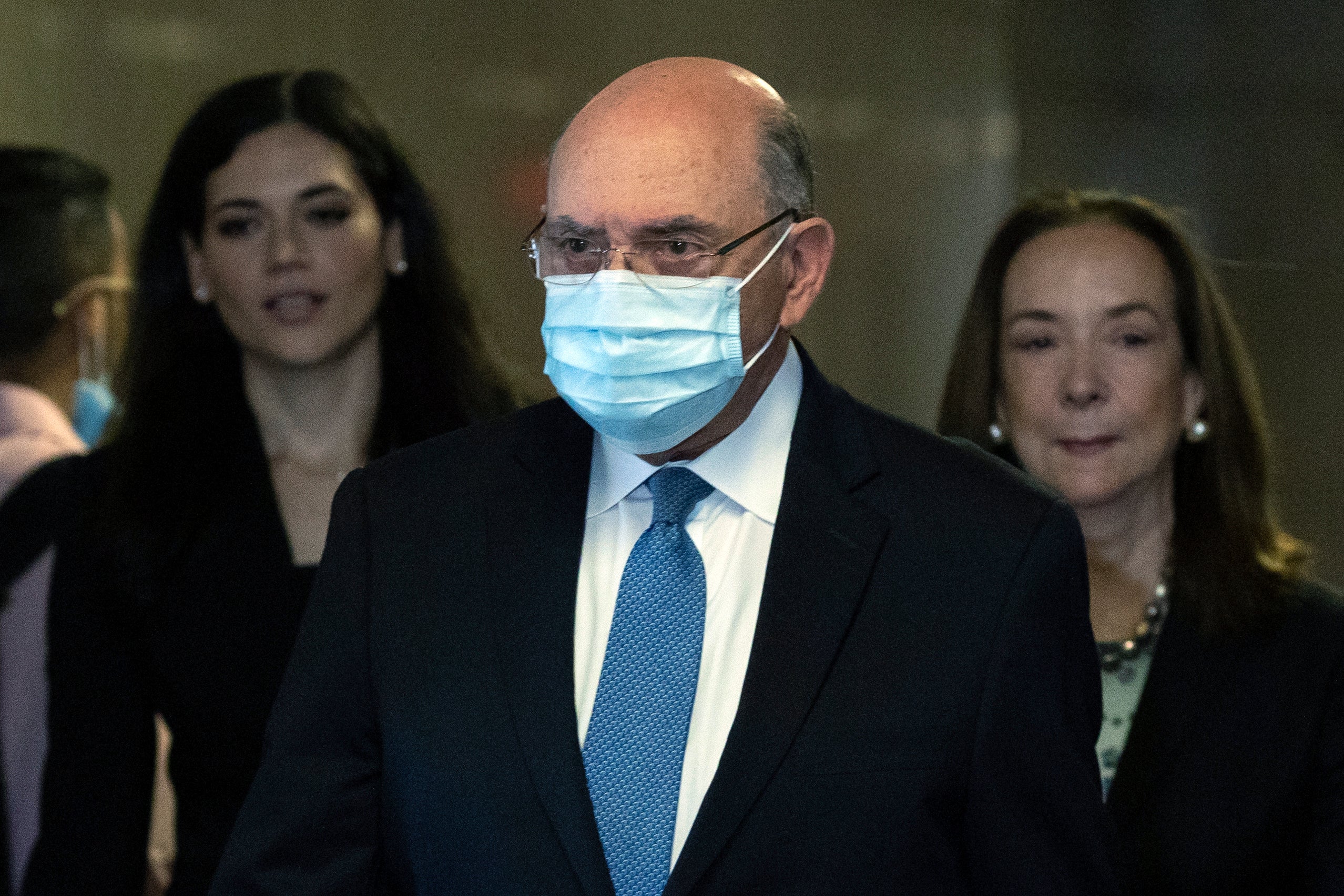

The company faces allegations that it enacted a scheme to help executives avoid paying income tax in a case that has entangled the company’s longtime Chief Financial Officer Allen Weisselberg.

The trial comes amid a litany of legal issues facing the former president, who was recently subpoenaed by the House Select Committee investigating the January 6 Capitol riot.

According to the federal election commission, Mr Trump’s political action committee spent $4m on legal costs in August as he faces investigations into his actions related to the insurrection and his attempts to reverse the election results, taking classified documents from the White House when he left office, and a defamation case in connection to an allegation of rape.

The criminal tax fraud charges stem from allegations that Mr Trump’s real estate company located in Manhattan defrauded state tax authorities by providing compensation “off the books” over the course of 15 years to executives at the company, such as car lease payments, apartment rent, and tuition costs for relatives in school as part of their salary, allowing the firm to avoid paying taxes on payroll, The Guardian noted.

If the company is found to have violated the laws, it could be ordered to pay as much as $1.6m in fines and limits could be imposed on the company’s role as a manager of hotels, golf courses and other institutions.

The trial may connect to a separate investigation by Letitia James, the New York state attorney general. Last month, her office issued a lawsuit clocking in at 200 pages, which alleged that the Trump Organization, Mr Trump, and three of his children, made inaccurate claims of the value of real estate assets, as well as the net worth of Mr Trump, to get better loans from banks and coverage from insurers.

Prosecutor resigns arguing for felony charges against Trump

The probe into Mr Trump’s company was started by then-Manhattan District Attorney Cyrus Vance Jr and is now in the hands of the current DA Alvin Bragg.

In February, two prosecutors spearheading the investigation resigned – one of them argued that Mr Trump should face felony charges.

Trump lawyers argue case is political

Trump Organization lawyers have called the case “selective prosecution” prompted by contempt for the former president’s politics. Judge Juan Merchan, who’s in charge of the case, has dismissed that argument.

The attorneys also said that the prosecutors are working to penalise Mr Trump’s firm because “a handful of its officers allegedly failed to report fringe benefits on their personal tax returns”, according to The Guardian.

The case is important for both the government prosecutors and Mr Trump. While his allied attorneys struggled to make coherent arguments in their attempts to overturn the 2020 election results, the Trump Organization has employed top lawyers, in this case, to push back on allegations pushed by prosecutors working to overcome the high burden of proof.

Focus on Weisselberg’s testimony

Much of the focus will be on the testimony of Weisselberg. The 75-year-old executive was charged last year in an indictment by the DA. He has pleaded to 15 counts – including grand larceny, tax fraud, and falsifying business records.

Weisselberg was subpoenaed for his testimony and isn’t a cooperating witness, the paper noted. He has an agreement with the prosecutors for a sentence of five months, which is conditioned on him providing accurate testimony – the DA has made sure that his sentencing will take place after this case.

To show that the Trump Organization broke the law, the prosecutors can show that Weisselberg and other executives, such as Mr Trump, are liable. The government may try to prove that they knew that the tax-avoiding scheme was in place.

‘A really difficult case both for Weisselberg and Trump’

Former federal prosecutor Andrew Weissmann told The Guardian that “it’s strategically a really difficult case both for Weisselberg and Trump because they could end winning the battle and losing the war”.

“If they do a typical defence cross-examination of Weisselberg and they catch him in some sort of lie then his deal is over and the pressure on him to flip” on Mr Trump “is going to be that much greater”, he added.

Mr Weissmann noted that the Trump attorneys can’t try to discredit Mr Weisselberg without possibly handing over evidence that Mr Trump was aware of the scheme.

“The idea that Trump didn’t know is going to be the critical thing that Weisselberg is asked about”, he told the paper. “If he denies that Donald Trump knew, you can see the judge saying, ‘I don’t believe it and I’m going to take that into account when I sentence you.’”

‘Bragg’s allegations are much more concrete’

Mr Weissmann compared the DA’s case to the civil complaint lodged by Ms James, saying that “Bragg’s allegations are much more concrete because they allege making payments that were clearly part of the person’s salary, keeping track of them, but only reporting what was listed as salary”.

“The problem for the defence is that if they say this is a grey area and isn’t a crime, they have to say that Weisselberg is lying,” he added. “If the judge agrees, Weisselberg is in a tough position.”

Opening statements begin

Opening statements in the trial began on Monday 31 October. The proceedings in the New York Supreme Court may go on for as long as six weeks and are expected to include witnesses still active at the company, such Mr Weisselberg, who’s currently on paid leave, according to The Washington Post.

Another possible witness is comptroller Jeffrey McConney – a grand jury witness who has been afforded immunity from prosecution.

Prosecutors have recently told possible jurors that some of the witnesses may hesitate to take part.

They “may be reluctant at times to answer some questions,” Assistant District Attorney Susan Hoffinger told jurors on Thursday.

“It’s understandable … They are testifying against their employers,” she added.

On Monday, Ms Hoffinger blasted the argument pushed by Trump lawyers that the probe was a witch hunt motivated by politics.

“This case is about greed and cheating, cheating on taxes,” she said.