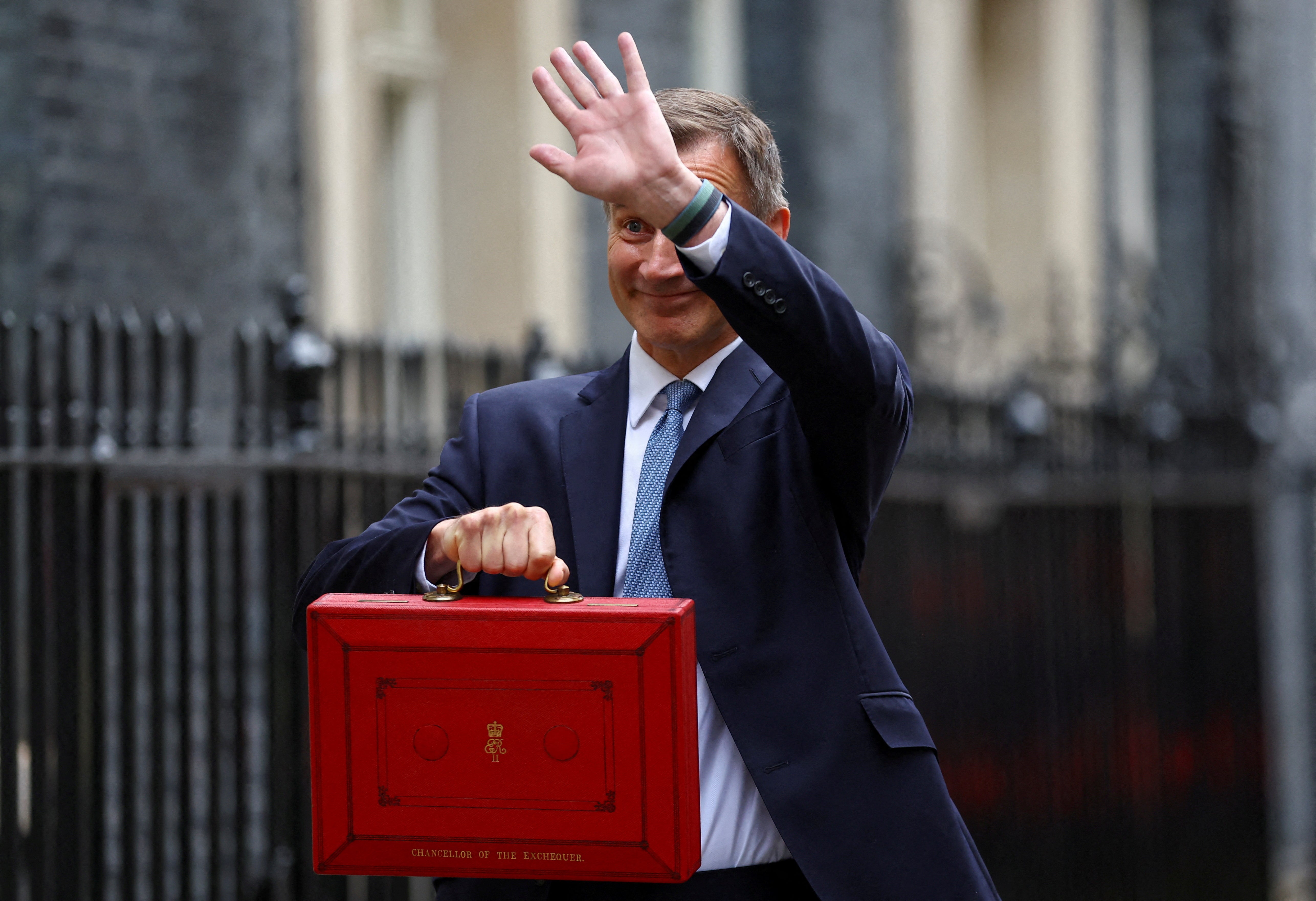

Jeremy Hunt’s Budget shows exactly what this government’s top priorities are

Letters to the editor: our readers share their views. Please send your letters to letters@independent.co.uk

The recent Budget announcement clearly shows that innovation, productivity, and economic growth are at the top of this government’s priorities. While the chancellor’s 6 per cent increase in the main rate of corporation tax will come into imminent effect in the new financial year, he has avoided increasing the burden for smaller businesses and those generating the lowest profits. For those who are impacted, there will be a cash squeeze from the increased rate, but this will likely take time to filter through and materially impact investment decisions.

Nevertheless, for UK businesses concerned about the impact this increase will have, especially in light of the current inflation levels, cost of living impact, and interest rates, now is the time to plan ahead. This includes looking at cash flow forecasting, re-evaluating future investments strategically, and thinking about downside protection for their business. Automation and outsourcing will play a key role here, allowing organisations to be flexible and streamline operations where possible, and keep operating costs as low as possible.

Businesses of all sizes, but especially SMEs as the foundation of the UK economy, need to take greater advantage and make complete use of the existing government grants and schemes, such as the new full capital expense research and development tax relief. It will be interesting to see how the 12 new “investment zones” will help to stimulate growth through tax incentives, offsetting the effect of the headline increase in corporation tax.

The more the government can support SMEs through these schemes, the more empowered they will be to focus on business innovation and productivity, which directly impacts economic growth.

Michael Cox

CFO at IRIS Software Group

The BBC remains a treasure for us

I suspect David Nelmes is spending too much time watching other channels and missing the many excellent and diverse programmes on the BBC.

If you truly cannot find any educational, cultural, entertaining, or groundbreaking shows from their wide portfolio then you may want to withdraw your license fee. For most people, however, the cost per month is less than most subscription channels, which are usually restricted in their programming or charge more for other areas.

To quote directly an article in The Independent regarding The Repair Shop programme, “not unlike the BBC itself, in fact, a century-old global treasure of craft and creativity currently being carelessly trashed by this government. When it’s gone, there’ll be no Repair Shop to try to stick it back together again. So let’s try to take care of it in the meantime.”

Rob Alliott

Cambridge

This ‘big win’ feels like clutching at straws

I knew about the problems with doctors’ pensions years ago, although I had no connections to the medical profession or the pensions sector. Politicians could have handled this at the time but chose not to. Hailing this as a big win now feels very much like straw-clutching from a near-empty bag of ideas! And remember many of us warned, including John Major, that leaving the EU would cause an exodus from the NHS.

Robert Boston

Kent

Society still has a limited understanding of disability

Recently the topic of dancers in wheelchairs has been hard to miss with the announcement from Strictly Come Dancing that a contestant this year will be a wheelchair user, as well as Kate Stanforth recently dancing on Channel 4’s The Last Leg. While we are very excited to see this, the internet trolls commenting on these topics prove there is a still long way to go.

As a society, there is still such a limited understanding of disability. Most conditions don’t follow a path where you can either comfortably walk all the time without pain or exhaustion or where you need to permanently use a wheelchair all the time. Deterioration of mobility often happens gradually.

This is an issue we see so frequently at Whizz-Kidz – the UK’s leading charity for young wheelchair users. Young people and their families come to us for wheelchairs because restrictive NHS criteria mean that local wheelchair services are unable to prescribe a wheelchair to a young person who can walk, even if they can only walk a few metres before they are completely exhausted. Indeed, young people with cerebral palsy make up 40 per cent of those support through access to our specialist wheelchairs.

What concerns me right now is the increase in young people applying to Whizz-Kidz because budget cuts are forcing even more NHS wheelchair services to refuse a child a wheelchair on the basis that they can walk across a small room.

Cerebral palsy can sap a young person’s energy quickly and exhaust them. They should have the choice to conserve their energy to walk when it is most important to them – such as being in the playground or participating in a dance class, instead of sapping their energy reserves walking between classrooms or to lunch break. Managing energy in this way will often help a young person to continue to participate in school and in society in the way they wish until a much later age.

Having a chair where you can be independently mobile is crucial for every young person’s development, and at Whizz-Kidz we believe it is a fundamental right for children and young people. We will continue to fight for a world in which every young wheelchair is mobile, enabled, and included.

Sarah Pugh

Chief executive at Whizz-Kidz

In the middle of a live televised debate, it is unsurprising if Fiona Bruce made a mistake

The BBC’s impartiality guidelines constitute a worthy document which seems to seek to establish balance, inclusion, fairness, and a measure of respect for facts and evidence. In any complex, democratic society media impartiality is a big challenge open, as it is, to vested interests and social division.

The document explains the need to create space for alternative views and to give weight to levels of controversy, a wide range of audiences, and the need for objective evidence. We can all remember when, slightly confusingly, BBC presenters began routinely supplementing remarks of guests and contributors with fatuous reminders of the type that “other views are available”. It seemed odd when it became more common and it is odd.

In general, potentially controversial remarks like that made by Yasmin Alibhai-Brown on Question Time would be better defended by the person who made them. Either at the time or later. In the heat and pace of a more or less live televised debate on complex and controversial matters, it is unsurprising if presenters – in this case Fiona Bruce – make the occasional inadequate caveat.

David Lowndes

Southampton

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks