Martin Lewis gives verdict on Jeremy Hunt’s Budget and reveals who will be better off

Martin Lewis has provided clarity on what the government’s announcement on Wednesday really means

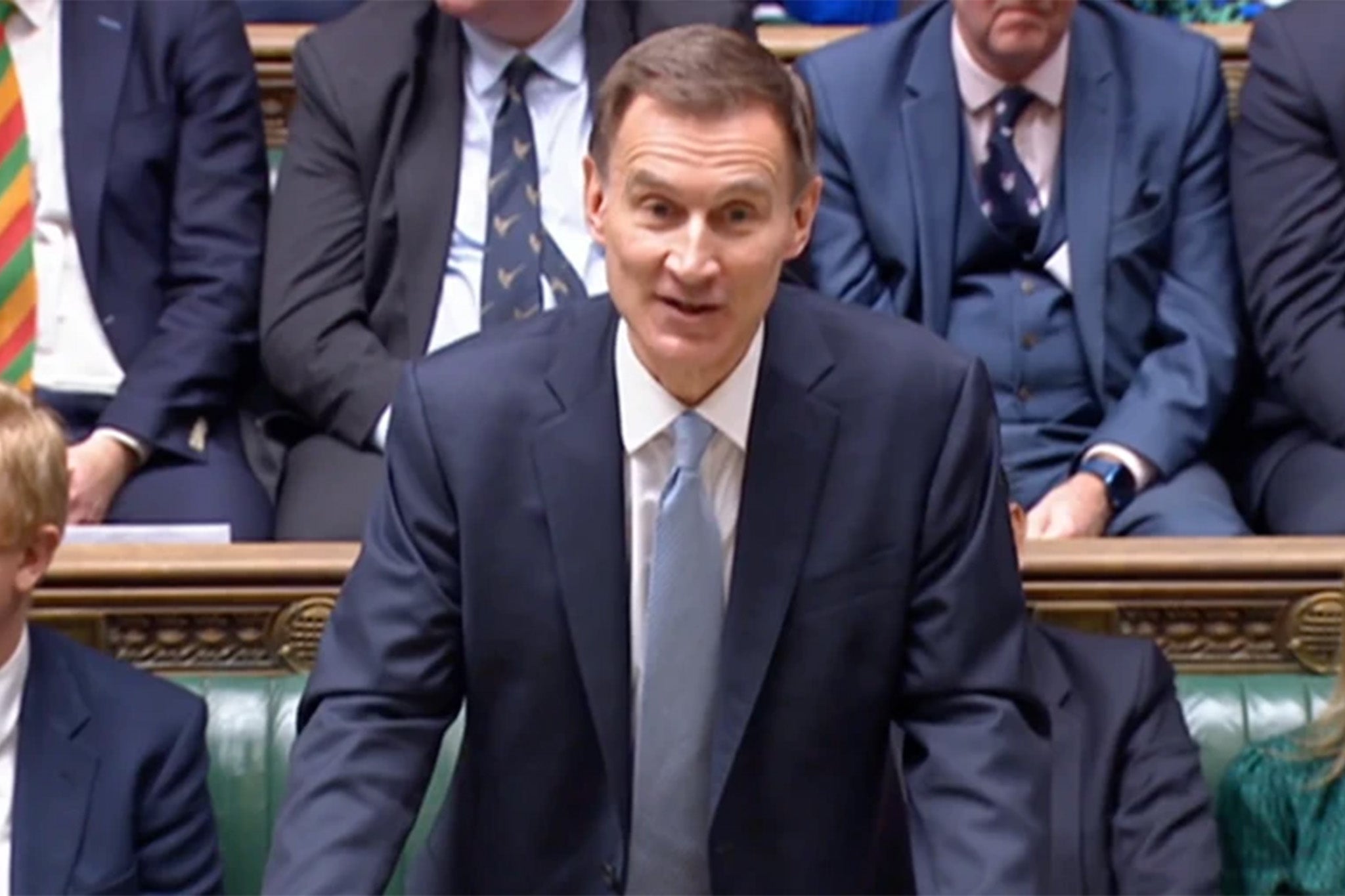

Money-saving expert Martin Lewis has given his verdict on Jeremy Hunt’s spring Budget after the chancellor made a series of major announcements.

He revealed that people on low incomes and those hit most by the cost of living crisis will benefit most from some policies, including changes to loans and Household Support Funds.

On Wednesday, Mr Hunt unveiled a bundle of new policies including a freeze on alcohol duty to be extended until February 2025, and a 5p cut to fuel duty is to continue for another 12 months.

In a series of social media posts, Mr Lewis explained what the changes mean for people as the announcement was being made in the Commons.

Starting with the chancellor’s claim that inflation will fall below the two per cent target in just a few months, the Money Saving Expert founder said: “So price rises predicted to slow (absolute prices will still be higher though - and unlikely ever to go back to where they were).”

Mr Lewis also highlighted positives from the Budget and explained how some with the lowest incomes could benefit from some announcements.

Households on Universal Credit who take out budgeting advance loans for emergencies will now have an increased repayment period for new loans from 12 months to 24 months.

Mr Lewis responded on X: “This is a welcome move. It lessens the burden on some of the payback of lowest incomes.”

He also backed the six-month extension of the Household Support Fund and said: “This is money for local councils to help the most desperate and the cost of living crisis means sadly there’s high demand. Would’ve been awful to cut it off right now.”

Another area people on lower incomes are set to benefit from is the cancellation of the £90 debt relief order.

Mr Lewis wrote: “Simplifying, these are a sort of easier form of bankruptcy for those with limited assets. The fact you have to pay for it has been a barrier to people who need help getting help. Very pleased to see the charge gone.”

The expert said the biggest win was the changes to child benefit, which means thresholds will rise for the first time since 2013.

“WE GOT THE WIN ON CHILD BENEFIT!” Mr Lewis posted on X.

He added: “Chancellor tipped me off before Budget, said this was due in large to MSE/my shows campaigning all based on all those of your who messaged me to say it was the key thing to put to him.”

“From this April threshold which hasn’t moved since 2013 rises from a single parent earning £50,000 to £60,000 and you lose child benefit totally at £80,000 (not £60,000).”

He added a consultation on moving it to family rather than individual income will help to stop unfairness on single-income households.

Jeremy Hunt also cut National Insurance contributions by two per cent in a move which will impact most people’s pay packets.

Responding to the measure, Mr Lewis said: “National Insurance cut in April by 2 per cent for working people and the self-employed. So that is a tax cut for WORKING PEOPLE (not pensioners) by another name.”

Earlier in the week, Mr Lewis explained what a National Insurance cut means on This Morning, explaining: “For a two per cent cut for each £10,000 you earn over £12,500, you will be £200 a year better off.”

One source of revenue that was confirmed is the scrapping of the “non-dom” tax status that allows foreign nationals who live in the UK, but are officially domiciled overseas, to avoid paying UK tax on their overseas income or capital gains.

The policy is a key plank of Labour’s plans and has previously been resisted by the government, but the opposition has said it could raise as much as £2 billion.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments

Bookmark popover

Removed from bookmarks